One trend we’ve identified that is showing evidence of long-term strength is the business of private commercial lending.

Did you know that there are several publicly traded private finance companies paying whopping dividend yields that specialize in venture capital, bridge and mezzanine financing, buyouts, business development, and mergers and acquisitions?

When was the last time you thought you could be in the same business as dealmakers Carl Icahn, Kohlberg Kravis Roberts & Co., or Kleiner Perkins, the latter of which happens to be the most prominent venture capital firm in Silicon Valley?

Most would believe that such an inside track to the “seed money-to-exit strategy” food chain was reserved for only the super-rich.

Well, guess what? I know of at least seven listed companies that are raking in profits thanks to the wave of startups, mergers and private capital formation.

These are the Business Development Companies, or BDCs as they are commonly referred to on Wall Street.

These aggressive finance companies manage tens of billions of dollars in loans and equity investments where margins are widening due to higher lending rates and fees. They charge clients to get deals done in a market where there exists a high level of deal flow.

In the current market, where demand for private capital continues to be at a premium, profit margins for these companies are running as high as 60%. The only other business I know of that has operating margins in that range is software.

However, you can’t get a 7% to 10% dividend yield in the software business and grow your capital at the same time. But you can in the specialty finance business.

Here’s a chance to invest in a sector of the U.S. economy that isn’t easy for the average investor like you and I.

It is small-to-medium-size businesses that really drive our economy and can produce life-changing wealth.

Yes, the wealthy invest directly in these companies or even participate via a venture capital firm or a private equity fund.

That’s why BDCs offer a great opportunity for the average income investor to participate. They are publicly traded companies that are both liquid and can be traded on any online brokerage account. This is a good formula and one that more and more income investors will adopt as an alternative for investing in growth companies and traditional income investments.

And BDCs have excellent long-term potential given the demographics of the American income investor. The baby boomer generation of the 1050s and 1960s are retiring in droves, and that makes for a bullish backdrop for those asset managers paying out hefty dividends.

Let’s look at one of these players.

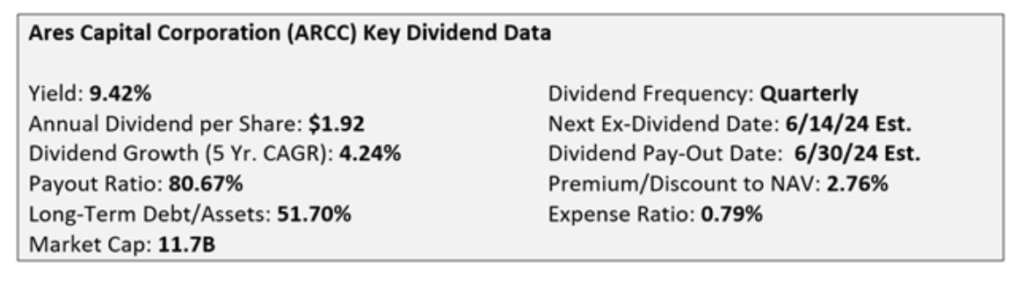

Ares Capital Corporation (ARRC): $20.48

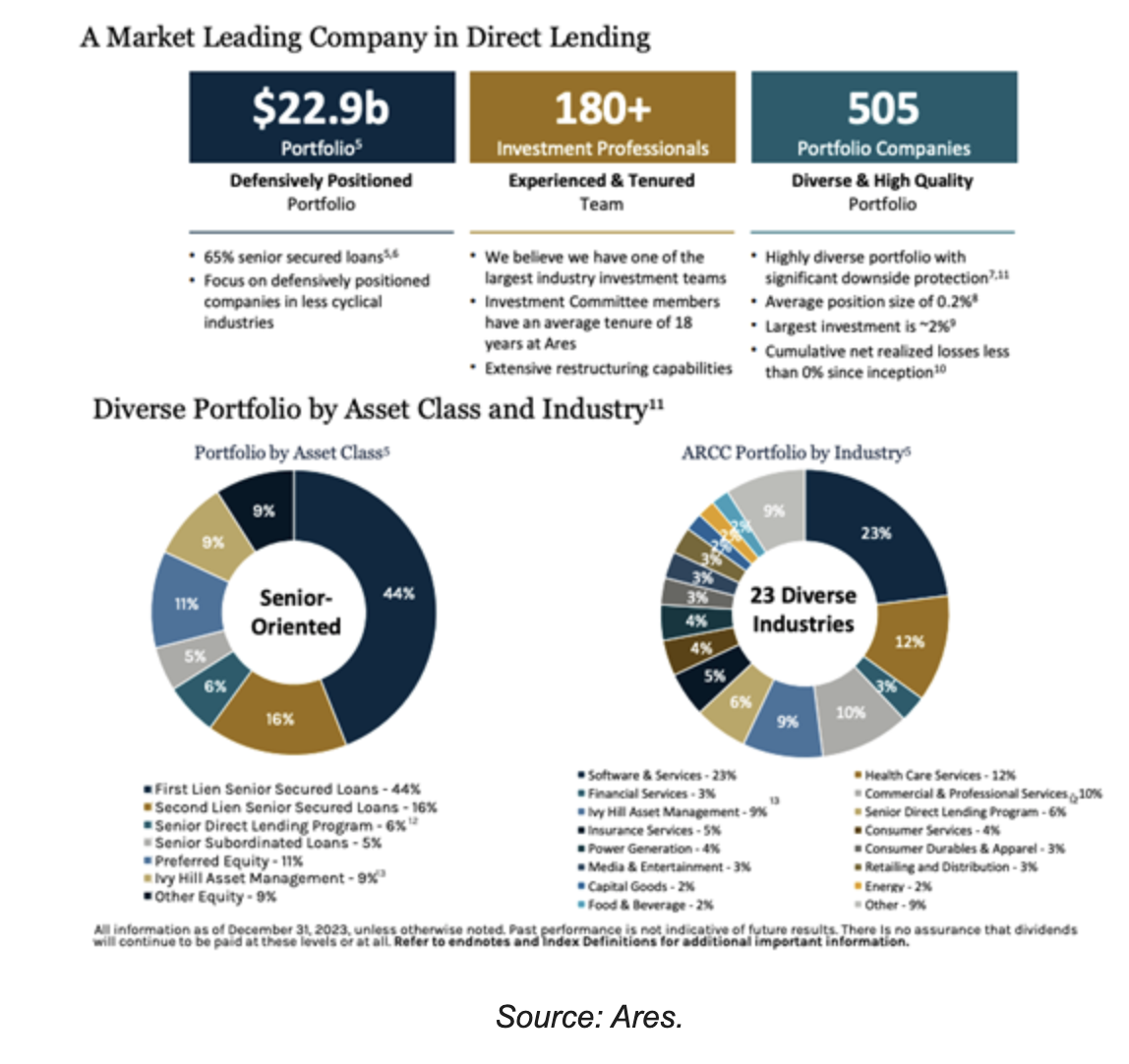

Ares is an independent, Los Angeles, Calif.-based investment firm with more than 180 investment professionals and approximately $22.9 billion of committed capital under management across 505 portfolio companies. Founded in 1997, it specializes in originating and managing assets in both the private equity and leveraged finance markets.

The company prefers to make investments in companies engaged in basic and growth manufacturing, business services, consumer products, health care products and services, and information technology service sectors.

Ares will also consider investments in industries such as restaurants, retail, and oil and gas, although its exposure to the energy market is relatively small.

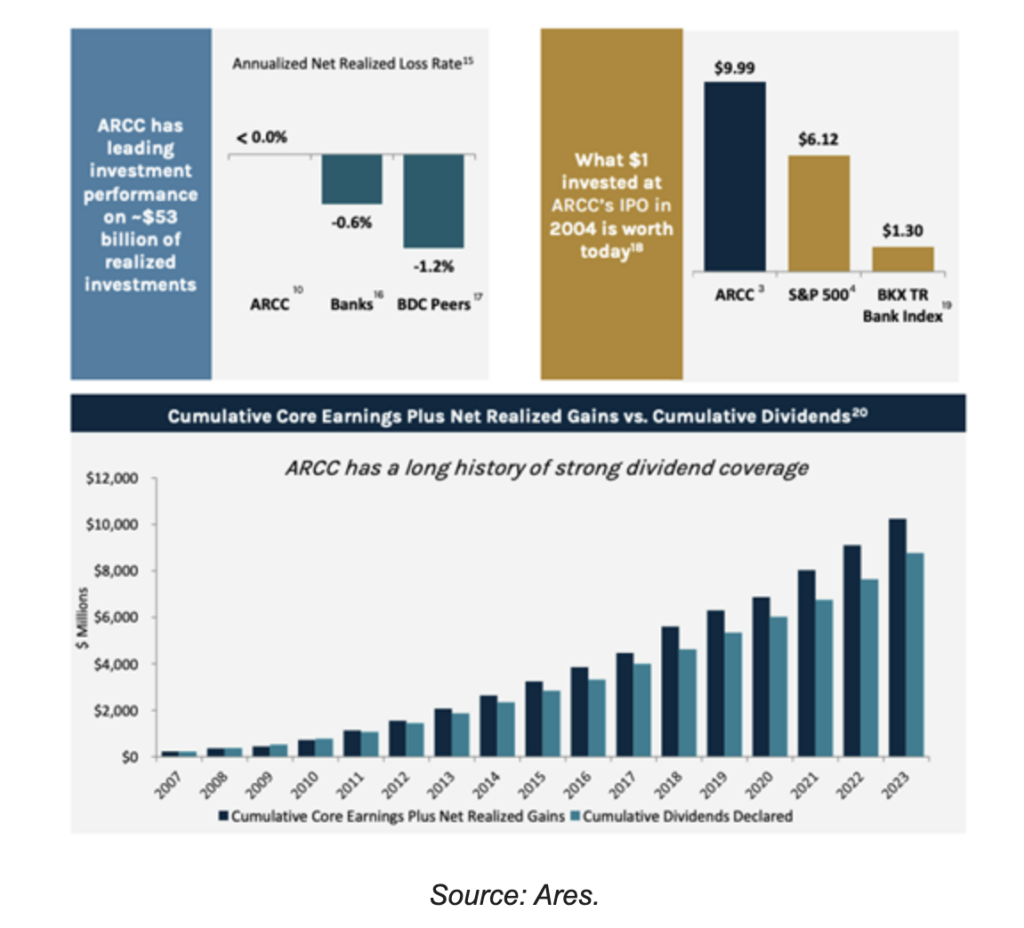

Ares Capital is one of the original BDCs, trading publicly since 2004. In fact, some investors refer to it as the “blue chip” of the BDC investments.

Since its inception, it has rewarded income investors with an average return of more than 11% per year with dividends reinvested, outperforming the S&P 500 index.

It’s the largest BDC in the world with a top-rate management team that is the longest-tenured team in the business. This team has managed the company through all kinds of market conditions including the numerous bull markets and the Great Recession of 2008.

Ares reminds me a lot of another public high-yield asset management firm, Blackstone (BX). That’s the kind of team we want to manage our income-first investing approach.

Here are some of the key factors working in ARCC’s favor, taken from a recent investor presentation:

- $22.9 billion loan portfolio

- Highly experienced and tenured team with 25 years average investing experience

- Sizeable portfolio management team with extensive restructuring capabilities that seek to enhance investment performance

- Disciplined underwriting process supporting highly selective approach

- Less cyclically positioned investment portfolio focused on upper middle market

- Invested approximately $60 billion with realized asset level gross IRR of 14% since IPO

- 83% of portfolio companies are controlled by PE sponsors believed to have significant resources to support businesses

- Deep sources of liquidity and committed capital with $4.4 billion of available liquidity

- Fortified balance sheet with significant unsecured, long-dated financing and low leverage

- Leveraging long-term capital to target attractive risk-adjusted returns

- Well-laddered debt maturities with no maturities until 2022

- Track record of generating strong returns for shareholders

- Compelling historical investment and credit performance during periods of volatility

Here are some of the interesting investments you can participate in through Ares Capital:

- A developer, builder and owner of utility-scale wind and solar power facilities

- A provider of outsourced crew accommodations and logistics management solutions to the airline industry

- Developer and operator of electric vehicle charging stations

- Provider of environmental, health and safety software to track compliance data

- Medical technology company focused on value-based care services and payment solutions

- Provider of data analysis, statistics and visualization software solutions for scientific research applications

- National utility services firm providing engineering and consulting services to natural gas, electric power and other energy and industrial end markets

- Medical device company focused on treating cardiovascular and neurological diseases

And these are not just hopeful startups. Many of these investments are in solid small- and medium-size companies that are on a growth path with more upside potential.

Despite this and a 15-year track record of outperformance, ARCC’s current valuation is well below its peers. This stock is still cheap compared with other BDCs that are trading at a much higher valuation.

As dividend hunters, we look for safety in our future dividend payments. ARCC has no problem covering its dividend with $4.4 billion of liquidity available.

Recommendation: Buy Ares Capital Corporation (ARRC) shares at market for appreciation and dividends.