Recent events have underscored the importance of being prepared for market downturns, prompting me to explore a strategy I use to hedge my portfolio from time to time.

Yesterday’s market shift, catalyzed by Minneapolis Fed President Neel Kashkari’s remarks on inflation, saw the S&P 500 plummet over 1%. This deviation from recent norms signals a potential shift in market sentiment, prompting a reevaluation of my investment strategies.

In this article, I’ll delve into the technical nuances behind this market movement and introduce a put ladder hedge strategy aimed at mitigating further downside risk.

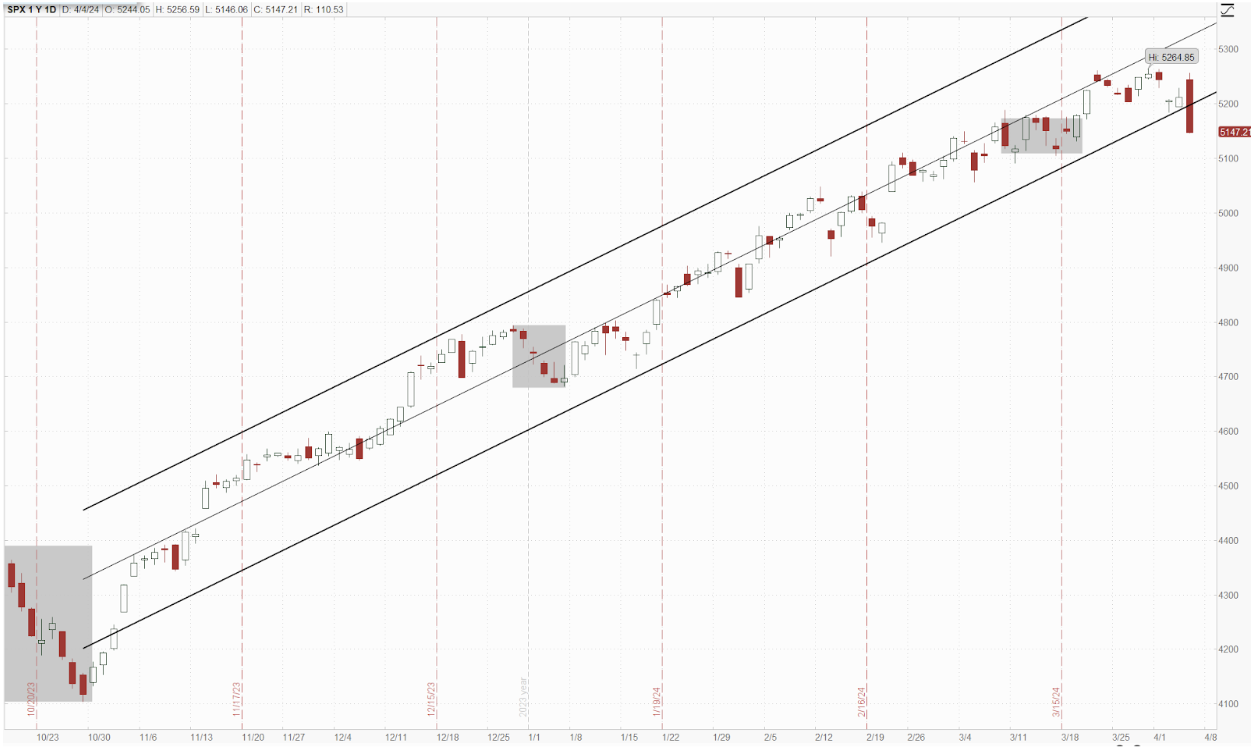

Firstly, let’s dissect the technical indicators that have emerged. The market, riding a sustained uptrend, saw yesterday’s closure breach the established trend channel, a significant departure from recent patterns.

Additionally, the formation of an “M” reversal pattern, indicative of a bearish trend reversal, further highlights the mood shift. It’s characterized by two peaks, with a moderate decline between them, that resembles the letter “M”. The first peak is usually formed after a strong uptrend, and the second peak forms after the price moves to the neckline. The second peak is not registered as a higher high, but rather as an equal high. This formation can indicate that investors are seeking to obtain final profits from a bullish trend.

This shift in sentiment may be attributed to investors’ anticipation of future rate cuts, which Fed speakers are saying may not come until much later in the year, if at all.

Enter the put ladder hedge strategy. By strategically purchasing put debit spreads across varying expiration dates, I aim to protect my portfolio against a potential downturn while minimizing capital exposure.

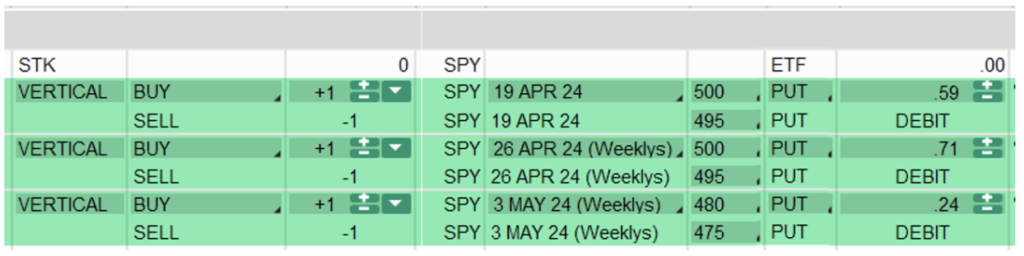

Allow me to outline the proposed trades:

Purchase the 19 APR put debit spread: Buying the 19 APR 500 put while selling the 19 APR 495 put, with a debit of 0.59 or $59 per spread.

Purchase the 26 APR put debit spread: Buying the 26 APR 500 put while selling the 26 APR 495 put, with a debit of 0.71 or $71 per spread.

Purchase the 3 MAY put debit spread: Buying the 3 MAY 480 put while selling the 3 MAY 475 put, with a debit of 0.24 or $24 per spread.

The cost for all three is roughly $1.54 (or $154).

Collectively, these trades offer a strategic hedge against potential market downturns, with the potential for significant gains should the market move downwards.

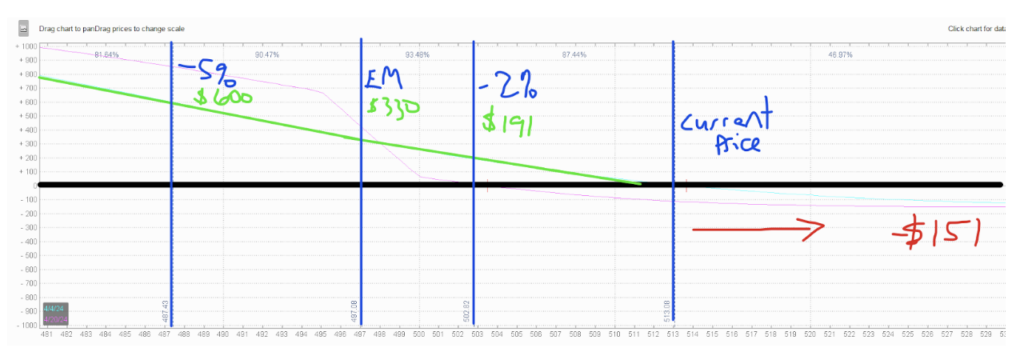

By analyzing the profit/loss graph, we observe the potential for substantial returns relative to the risked capital. Even a modest 2% market decline could yield over a 100% gain on risked capital, with larger declines offering even greater returns. EM in the chart equals the implied volatility expected move for the next 3 expiration cycles.

However, it’s essential to acknowledge the time-sensitive nature of this strategy, with diminishing potential profits as time progresses in the absence of a sustained market downturn. Theta decay will occur so the quicker the downturn happens (if at all) over the next few weeks will yield better returns.

It’s also important to remember that it’s a hedge strategy. While I don’t want the market to move lower, and I don’t like losing money on hedges, I’m ok putting a small portion of my portfolio towards a strategy that can help protect the rest.

As we navigate the evolving market landscape, I’ll continue to monitor and report on the efficacy of this strategy in the weeks to come.