We closed 13 trades across our services last week, all of which were winners, netting nearly $2,000 in cash in the live account.

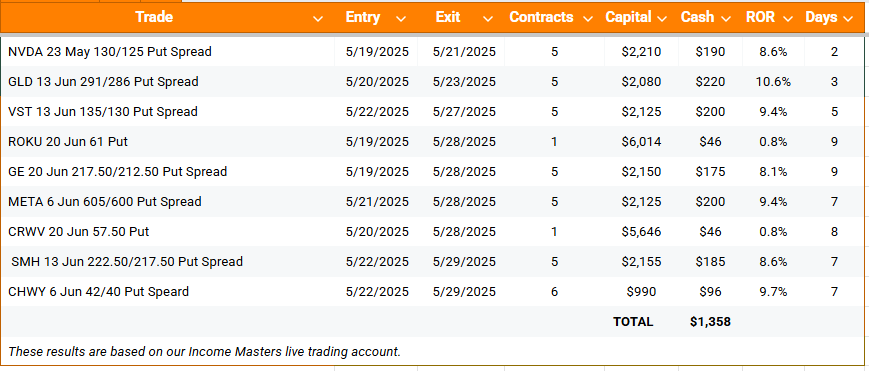

Here are all the closed trades from the week of May 26-30:

We continued to close out positions from our Millionaire’s Trading Club three-day virtual event, exiting 10 of our 14 positions thus far. From those trades, we’ve generated more than $1,600 in cash in the live account. This puts us nearly two-thirds of the way to our $2,500 income goal.

We also closed seven more of the trades from the latest round of Income Madness, which generated the bulk of last week’s profits.

In total, we’ve closed nine of the 14 trades we put on during four days of back-to-back live trading sessions. This brings our total profit to $1,358 in the live account in just 11 days, with an average return of 7.3% per trade and an average holding time of 6.3 days.

However, if you removed the two cash-secured puts from the calculation, our average return per trade shoots up to 9.2%.

For traders primarily focused on maximizing leverage and generating higher rates of return on allocated capital, the bull put spread offers significant advantages over cash-secured puts. These include:

- Lower Capital Requirement/Superior Leverage:

For a cash-secured put, you need to set aside 100% of the strike price in cash (or a significant margin equivalent) for each contract. This is the capital that secures your obligation to buy the shares if assigned.

For a bull put spread, the capital required (margin) is significantly lower. It’s typically the difference between the strike prices minus the net credit received. The long put acts as insurance, limiting your downside risk and, consequently, the capital your broker requires you to hold.

- Higher Potential Return on Capital (ROC):

Since the capital requirement for a bull put spread is much lower, the potential rate of return on the capital at risk is significantly higher, assuming a similar net premium received.

- Defined and Limited Risk:

While a cash-secured put also has a limited maximum loss (if the stock goes to zero, you lose the strike price minus premium), the amount of that potential loss can be very large if the strike price is high. The visual of having to potentially buy a rapidly falling stock can be unsettling.

A bull put spread, by capping the loss at the difference in strikes (minus credit), provides a much clearer, smaller, and psychologically more manageable maximum loss figure, which can be reassuring for traders.

- No Stock Ownership Obligation:

With a cash-secured put, if the stock falls below the strike price, you are obligated to buy 100 shares of the stock at that strike price. If your primary goal was just to generate income and not necessarily acquire the stock, this can be an undesired outcome, especially if the stock continues to fall after assignment.

With a bull put spread, even if the price falls below your short strike and you are assigned shares, your long put limits your obligation.

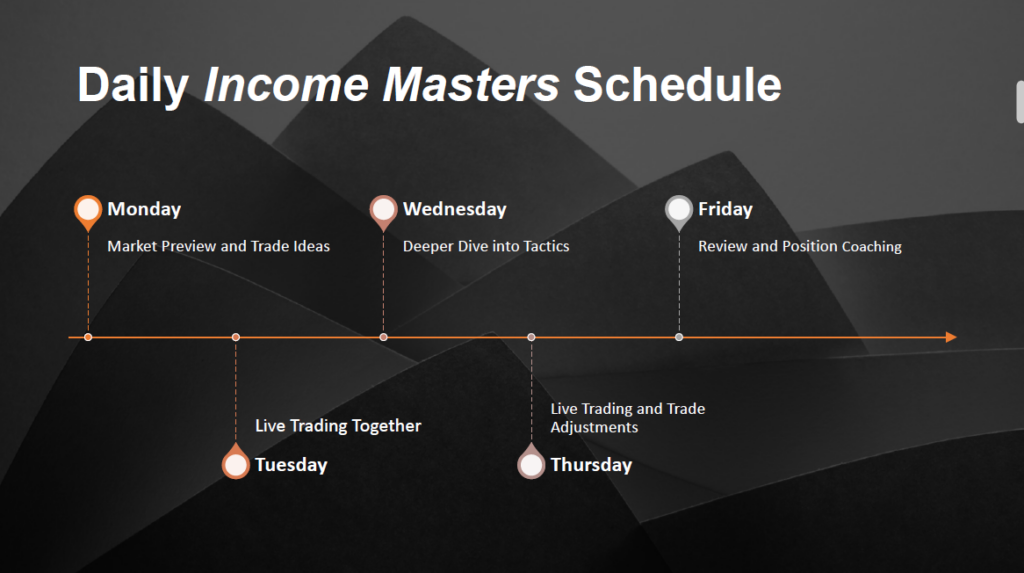

As you’re likely aware, we are making some big changes at Traders Reserve. Next week, we are transitioning to daily live sessions for the Income Masters program, which will be held at 12:30 p.m. ET each day.

In addition to entering and managing positions live, we will also offer a market preview, as well as position coaching and a deeper dive into the tactics we use.

For our first tactical deep dive, which will be held on June 4, we plan to cover how to get the best fills on adjustments for credit spreads, which include bull put spreads. This will be followed on June 11 by a session on how to defend credit spreads that go against you.

We hope you will tune in.