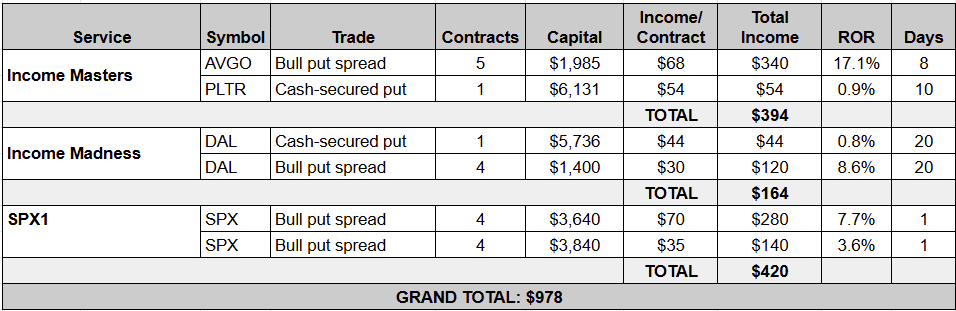

Last week was a relatively slow one by Traders Reserve standards, with a focus on managing existing positions and closing out a few profitable trades. We exited six winning trades across our services and booked $978 in cash.

That might not seem like much when you consider we pocketed between $1,600 and $4,000 in each of the prior three weeks, but it’s certainly not bad by any stretch of the imagination.

Here are all the closed trades from the week of Dec. 9-13:

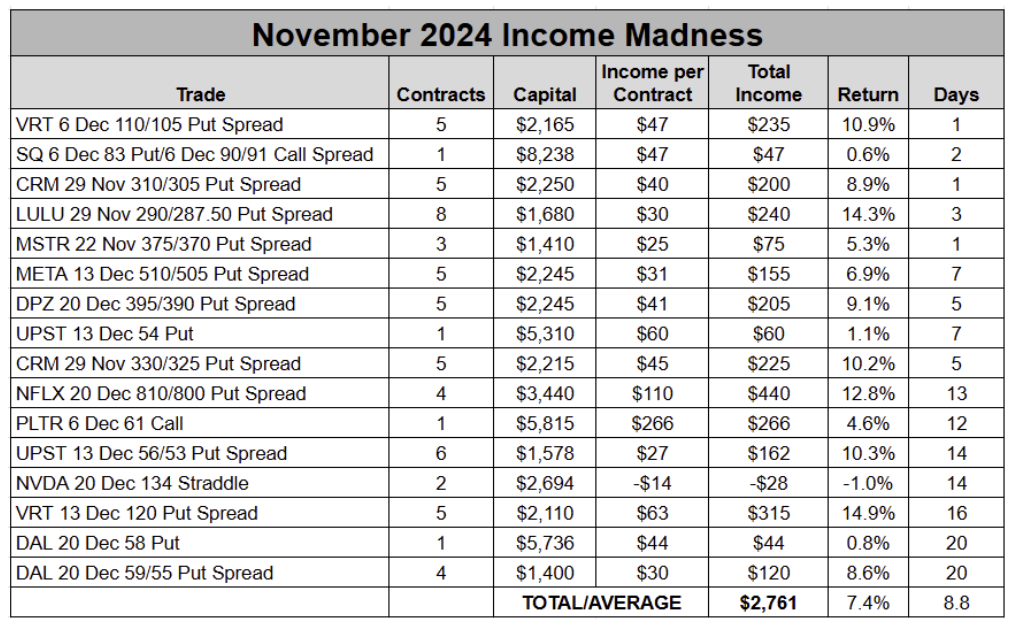

Last week’s closeouts included two more Income Madness trades. We’ve now exited all but one of the 17 trades we put on during our four back-to-back days of live trading, earning more than $2,700 in cash.

We used four different options strategies during Income Madness: the cash-secured put, the bull put spread, the jade lizard and the long straddle. Each of these has its benefits and potential drawbacks. Bu as you can see in the table above, the strategy we utilized the most – and the one that brought us in the most cash — was the bull put spread.

This leads me to the trade, or trades rather, that I want to examine more closely: the pair of Delta Air Lines (DAL) positions from Income Madness. And the reason for doing so is that they clearly demonstrate the benefits of trading bull put spreads over cash-secured puts.

If you’ve been with us for a while, you may remember that the vast majority of Income Madness trades used to be straightforward cash-secured puts. And we still trade them.

But cash-secured puts have the potential to tie up a large amount of capital. And fewer low-priced stocks have shown up on our scans recently. Many of the best opportunities we see are in stocks with triple-digit share prices, which require a lot of options buying power when selling puts.

As a result, we’ve begun to favor bull put spreads, which serve to both reduce our capital requirements and boost our rates of return.

However, we know many of you like trading cash-secured puts. So, on occasion, when we are trading a lower-price stock, we may offer two trading ideas and let members decide which route they want to go.

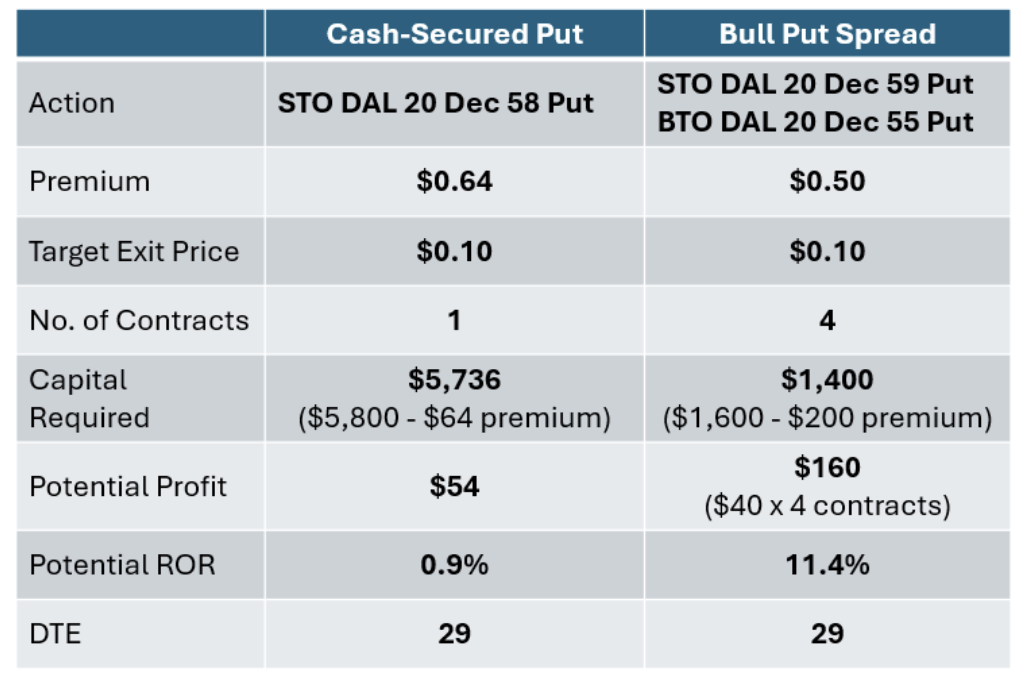

This was the case with the Delta trade we entered on Nov. 21. With the airline’s shares trading at $64.45, we recommended members sell a cash-secured put (CSP) OR a bull put spread (BPS).

Here’s what the trades looked like side by side:

Trading a single cash-secured put on DAL with a 58 strike required $5,736 in capital ($5,800 minus the $64 we collected in premium). Meanwhile, each 4-wide spread required $400 in capital less the $50 in premium collected, or $350. Since we traded four contracts, our total capital commitment was $1,400, or less than one-fourth of the capital required for just one cash-secured put.

The benefit of trading multiple contracts is that you can generate more income. While we brought in $50 per spread, trading four contracts meant we had $200 cash in hand. To get close to that level of income with the cash-secured put, we would have needed to trade three contracts, which would have required putting up more than $17,000 in capital for a single trade. This is why we typically stick to just one contract with cash-secured puts, or two if the price of the underlying is low enough.

And as you can see above, the potential return on our capital was much more attractive with the bull put spread option (11.4% for the BPS versus just 0.9% for the CSP).

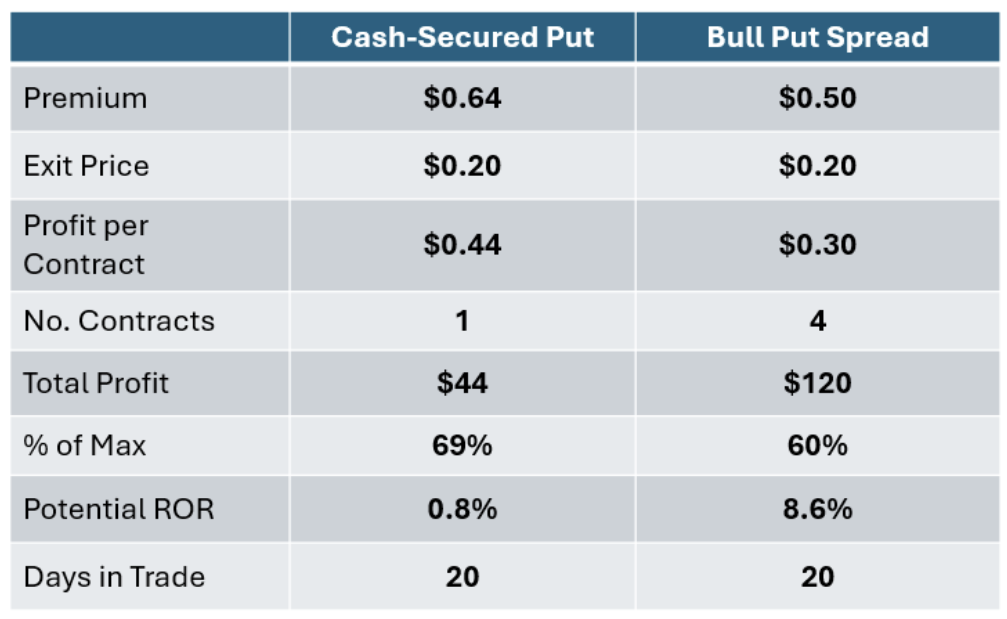

Now we didn’t quite make it to our target exit price on either trade, opting instead to close both early at $0.20. With the stock appearing to stall out and the Federal Reserve meeting on the horizon ahead of the Dec. 20 expiration date, we decided to take profits off the table.

We earned $44 on the CSP, which was 69% of our max profit. And while we earned just $30 on the BPS, or 60% of our max profit, the higher number of contracts resulted in a total profit of $120. Furthermore, our rate of return on the spread of 8.6% in 20 days dwarfed that of the cash-secured put at just 0.8%.

While we will continue to trade cash-secured puts, it is clear that bull put spreads offer traders a number of advantages.

Of course, there are disadvantages as well. The main one is that spreads can be harder to manage when a trade goes against you, as it’s tougher to collect credit when rolling spreads than single-sided options. Additionally, spreads may be more costly in terms of commissions and fees due to their multiple legs.

But, overall, credit spreads are a great way to leverage your capital and boost your rates of return.