Well, that was a week, wasn’t it?

I have been with Traders Reserve for nearly eight years. During that time, we have never had a week with as many trades — closeouts, adjustments and new positions — as we did last week.

In fact, I counted the number of alerts I sent: 25 in total — well, 26 if you count the 3M (MMM) correction – covering 39 different positions. I don’t know about you, but I’m exhausted.

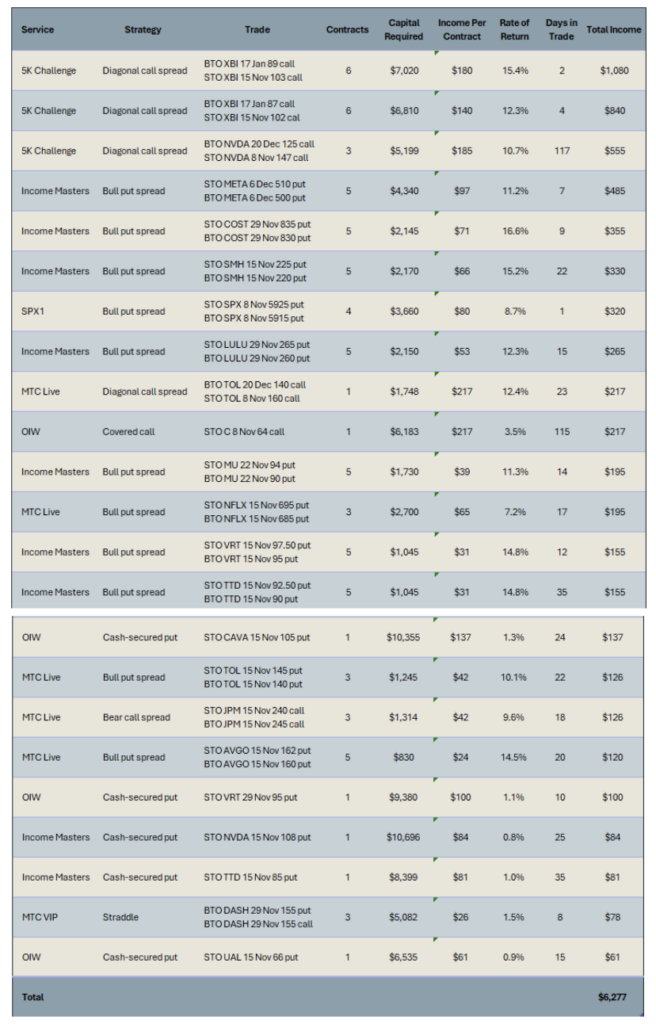

As I said last week, we will be devoting the Monday edition of Filthy Rich, Dirt Poor to reviewing the prior week’s results across all of our services. As you can imagine, the list of closed trades is quite long.

As the market ripped higher post-election and post-Powell, we closed out 23 positions – all of them winners – netting nearly $6,300 in cash in the live account.

Here is a look at all of the closed trades from the week of Nov. 4 to Nov. 8:

While we secured wins across all of our services, the standout trade – or pair of trades rather – is clear: the diagonal call debit spreads on SPDR S&P Biotech ETF (XBI) that we traded in the 5K Challenge program.

They were by far the best-performing trades from a cash perspective, accounting for more than 30% of the total cash we earned.

Back in early October, we made some adjustments to our process in the 5K Challenge program to better align our trading with our goal of averaging thousands of dollars per week in profits.

During a live webinar with members, we revealed some of the keys to hitting our aggressive goal:

- Limit tactics to defined-risk trades

- Utilize tactics where volatility and theta decay result in accelerated profits

- Scale up the number of contracts traded

- Actively trade in and out of positions

Our SPDR S&P Biotech ETF trades checked all of these boxes.

First, they were diagonal call debit spreads. This is a defined-risk strategy that involves buying a longer-dated call option with a lower strike price and selling a shorter-dated call option with a higher strike price. The risk with this strategy is limited to the initial cost of the spread.

Second, diagonal call debit spreads benefit from a significant increase in the underlying stock price as well as from the time decay of the shorter-dated option.

Third, we traded six contracts on both of these trades, amplifying our profits.

Finally, the XBI trades were the picture of active trade management.

We entered the first one during the 5K Challenge Live Trading Session on Oct. 31. At the time, the biotech ETF was trading at $96.89.

We bought the XBI 17 Jan 87 call and sold the XBI 15 Nov 102 call for a net debit of $11.35. Since we traded six contracts, our max risk was $6,810.

We declined to place a target exit price on the trade at that time, as we wished to see how the stock might trade before doing so.

The next morning, XBI was up almost 2% and our position was already sitting at a nice profit. We decided to place a good ‘til canceled (GTC) order to exit the trade at $12.75, which would give us a more than 12% return on risk if triggered.

That was on a Friday. The following Monday, our target exit price was hit, and we exited the trade with an $840 profit ($140 per contract x 6 contracts) in just four days

A few hours later, we went back to XBI with another diagonal call spread. With the ETF appearing range-bound, we were able to enter a new position with higher strikes for a similar debit to the previous trade.

Specifically, we bought the XBI 17 Jan 89 call and sold the XBI 15 Nov 103 call for a net debit of around $11.70. Again, we traded six contracts, this time risking $7,020, and we chose to hold off on placing a GTC order to exit the trade.

Well, I think you all know what happened next. Markets rallied hard following Election Day, with XBI piggybacking on bullish sentiment for technology stocks. With the ETF running up, we set a GTC order to exit for a $13.50 credit, targeting a 15%-plus return.

And we didn’t have to wait long. About an hour after we set our GTC order, it was hit. We grabbed a quick $180 per-contract profit in just two days, or $1,080 on six contracts.

These are exactly the kinds of trades we will continue to make in the 5K Challenge program, moving in and out of positions while taking four-digit profits on a regular basis. In fact, we’ve already entered another XBI trade, this time bumping the number of contracts up to seven.

Last week was a record-breaking one. And, yes, the strong market at our back was a huge help. But so are the defined-risk strategies we use and the steps we take to put the odds in our favor, even when the market hiccups. Because while stocks look set to finish the year strong, you never know what could happen next.

We’ll see you next week with another update on our trading results.