Happy Monday, and welcome to your inaugural Weekly Income Report. For the foreseeable future, we are planning a special weekly feature in the Monday edition of Filthy Rich, Dirt Poor that looks at the prior week’s results across all of the Traders Reserve services.

We will list all closed trades – the winners and the losers – to give you an idea of what we’re trading, the strategies we’re employing and the income we’re generating.

Each week, we’ll also highlight one trade for a more in-depth review. Sometimes this trade will be our best performer, either from a cash or rate-of-return perspective. Because who doesn’t like to talk about their winners? But we’re not just looking to brag.

So, some weeks we may review a trade because we think there’s value in discussing the underlying or the strategy we used. And other weeks we may choose to review a recovery trade or even a losing position if we think there is a lesson to be learned from it.

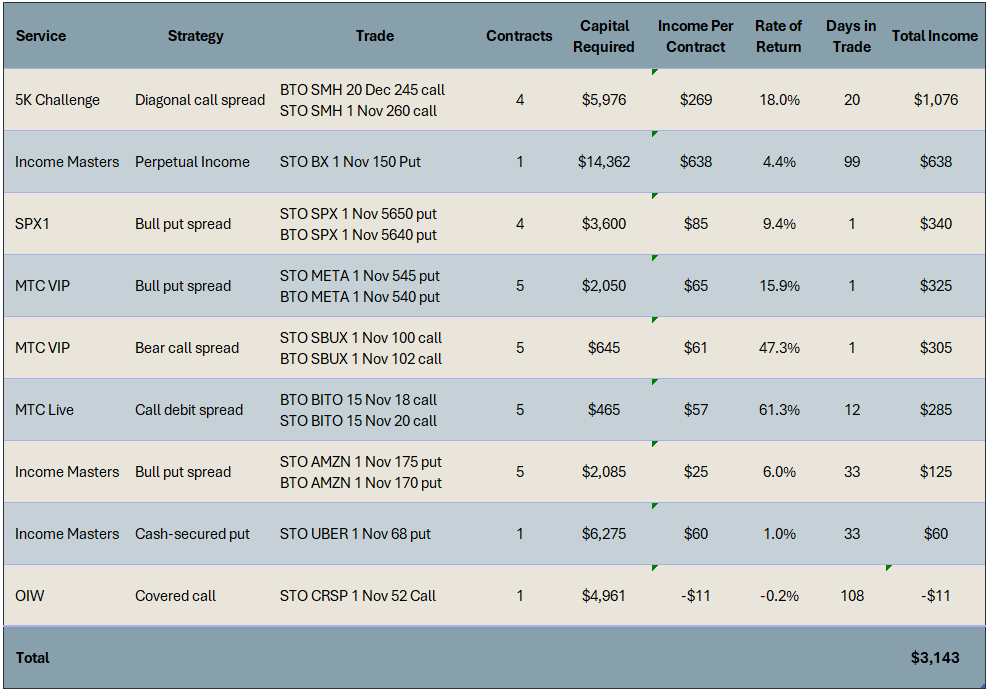

Here is a look at all of the closed trades from the week of Oct. 28 to Nov. 1:

As you can see above, the clear winner from a cash perspective is the diagonal call spread on the VanEck Semiconductor ETF (SMH) from the 5K Challenge service. And it’s not surprising that a 5K trade was the week’s leader on a cash basis. That’s because the 5K Challenge utilizes an aggressive growth trading style with a goal of averaging thousands of dollars per week of profits through the use of defined-risk trades and by scaling up the number of contracts traded.

From a rate-of-return perspective, last week’s standout was the ProShares Bitcoin ETF (BITO) call debit spread that we traded during last month’s Millionaire’s Trading Club live trading event in Las Vegas. Over three days, we put on 25 trades, making it the fastest-paced live trading event in Traders Reserve history.

The BITO trade was our 16th closeout, bringing our net cash to $6,930. (For more on our MTC results, check out this article.) While we’ve averaged a 14.3% return per trade on the ones we’ve closed thus far, the BITO call spread delivered a more than 61% return on risk in just 12 days thanks to the relatively low capital requirement.

In fact, at the time Jeff Wood recommended the trade in Las Vegas, he noted that what drew him to that particular 2-wide spread was the risk-to-reward picture with the max profit of around $110 per spread exceeding the max loss of about $90.

But the trade we want to look at a bit closer is actually the loser of the bunch, the CRISPR Therapeutics (CRSP) covered call from the Options Income Weekly program.

As you probably guessed, this is a recovery trade and the outcome could have been much, much worse had we panicked and sold shares at their recent lows.

CRISPR Therapeutics is a Switzerland-based biotechnology company that develops gene-based medicines. The company received its first major regulatory approval in late 2023 for gene-editing treatment Casgevy, which is used to treat sickle cell disease.

Options Income Weekly members found success with the stock in June, booking a nearly 1% return on a cash-secured put in less than 24 hours.

Our latest trade also began as a cash-secured put. On July 16, with CRSP trading at $61.39, we sold the CRSP 2 Aug 55 put for $0.68, or $68 per contract.

As you can see in the chart below, shares turned lower shortly after we entered the position.

As expiration neared, we rolled the put out and down to the CRSP 16 Aug 54 put for a credit, buying ourselves more time for shares to move higher and reducing our risk. However, we noted at the time that this roll was taking us out past the company’s second-quarter earnings date.

The stock sold off sharply in early August after the company reported a wider-than-expected loss and missed revenue estimates. Additionally, the lack of significant progress in its clinical trials and the overall cautious sentiment in the biotech sector contributed to the sell-off.

As CRSP languished through the fall, attempting to find support in the mid-$40s, we continued to roll our put, building up $2.77 in net credit.

We were eventually assigned shares at $53 apiece on Oct. 9. The stock hit a low that day of $44.44, or more than 16% below our assignment price. Even when you factor in the $2.77 in credit we’d built up, which brought our cost basis down to $50.23, we still would have taken a large loss had we thrown in the towel and sold our shares.

Rather than bailing on the position, we waited for the stock to trade higher, which happened early the next week. This gave us a chance to sell a covered call near our assignment price – the CRSP 1 Nov 52 call — for a solid credit.

As we headed into expiration, shares of CRSP shot up 7% in one day and our trade was sitting near breakeven. With the company expected to report earnings early this week, we decided not to risk it and issued a closeout alert.

We bought back the call and sold the stock, exiting with a loss of just $11 per 100 shares on a position that had been deep underwater just days before.

When selling cash-secured puts, especially on stocks with high implied volatility ranks (IVRs), you must be prepared for a position to go against you, forcing you to accept assignment. That is part of the risk associated with the strategy. But many traders dislike being assigned, and the urge to bail on a position that does can be intense.

However, it typically pays to avoid panicking and instead sell calls once shares have stabilized and can string together a few consecutive up days. While not every trade will benefit from a big pre-earnings move like we saw with CRSP, we’ve had plenty of other successful recovery trades prove the value of active trade management to reduce losses.

We hope you enjoyed this breakdown of last week’s trading results, and we’ll see you back here next Monday with a recap of this week’s results.