S&P 500 Hits New Highs, But Is the Rally Running Out of Steam?

The S&P 500 closed last week at record highs, capping a stunning 27.68% gain for the year. Yet, beneath the surface, cracks are starting to form. Market breadth is narrowing, some sectors are struggling, and key technical indicators are flashing caution. With big tech leading the charge and risks mounting in bonds and Bitcoin, investors ask: Is this the calm before the storm? Let’s see what’s fueling this rally—and why it might not last after the new year.

Your Weekly Income Report

Last week saw more than a dozen closeouts across all of our services and more than $3,900 in profits booked.

This week’s highlight might seem unremarkable at first glance. It wasn’t our biggest cash generator nor our highest return on risk. We didn’t uncover a new stock or employ a new options strategy. In fact, quite the opposite.

But there was something special about it.

Will The Ghost Of Christmas Past Visit the Market?

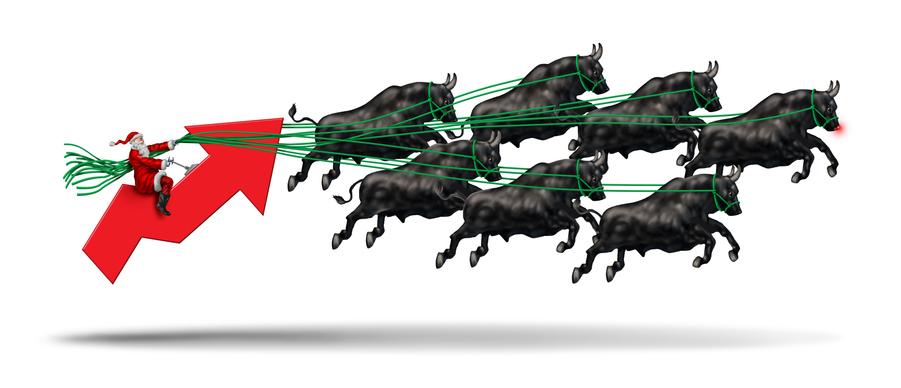

Earlier in the week I presented a bullish case for the markets to rise through the rest of the year, but then Thursday happened and the Russell 2000 dropped over 1%. The Dow followed suit and was down just over 0.5%. What happened and what could stop the end of the year holiday rally? The Ghost of Christmas Past.

Thanksgiving to Year-End: Will the S&P 500 Feast or Flounder?

As we say goodbye to one presidential administration and welcome the next, we’re sitting on potentially one of the greatest trading periods of the year. Hype is high, the volatility index (VIX) is low, and the markets continue to put in new highs. Even some of the larger banks are projecting another stellar year for 2025, but is now the best time to buy?

Your Weekly Income Report

Despite the holiday-shortened week, we managed to close eight trades and book $1,672 in profits across all of our services. These results were boosted by a handful of closeouts from our November round of Income Madness. We’re off to a great start, with a number of other trades close to hitting their target exit prices.

But last week’s highlight was a recovery trade that highlights the importance of carefully assessing an underlying stock’s fundamentals and technical factors when determining when to roll and when to cut losses.

Your Weekly Income Report

Last week’s results were a marked improvement from the prior one’s, with 11 profitable trades closed across all our services and $3,250 in profits booked.

This week’s highlight was a LEAPS call spread on Blackstone (BX), which offers both a great fundamental story and a great example of the power of leverage traders can find with what’s known as a poor man’s covered call.

You Can’t Give Up

Over the last few weeks, you’ve read our Weekly Income Report and have seen the gains and losses (few) from various services. One of the services we have not yet reported on is the 3-Stock Trading Strategy.

Markets Rise on Fed Comments, Chip Stocks Rally

Turkey day is around the corner (that’s Thanksgiving in the U.S.) and I for one am looking forward to a slower week ahead. For personal reasons, this has been a difficult month for me and I’m looking forward to a slower market week and some time off. Enough about me – let’s see what the markets did and where they could be heading next week and into December.

How to Tune Out the Noise—and Tune In to Real Market Signals

We’ve all heard it: “Don’t pay attention to the news.” And for the most part, it’s great advice. Financial headlines are designed to grab attention, not guide your trades. They’re often packed with hype, conflicting opinions, and a relentless focus on mega-cap stocks that dominate the indexes but may not dominate your portfolio.

But sometimes the news does matter. Knowing when to pay attention can help you navigate the markets with more confidence and less noise.

Your Weekly Income Report

Last week was a mixed bag, as we booked some significant wins and some painful losses.

This week, we’ll review a surprising dividend play that netted Millionaire’s Trading Club attendees more than $1,400 in less than a month. And we’ll also take a closer look at two big losses we took to see what lessons can be learned and why it’s important to take a bigger picture view, even when trading short-term options.