GOAL OF THIS ARTICLE:

This article is designed to equip you with a repeatable system for finding high-probability trade opportunities. You will learn how to:

Build a strategic watchlist that focuses on stocks with the highest premium potential.

Filter out low-quality tickers that lead to low returns and unnecessary risk.

Identify stocks with high Implied Volatility (IV), so you can stop chasing headlines and start trading with an edge.

WHO THIS IS IDEAL FOR:

This article is ideal for any options trader who wants to build a more consistent and systematic approach, especially if you:

Are tired of guessing which stocks to trade.

Actively sell options (like cash-secured puts or credit spreads) and want to find better premiums.

Are ready to stop gambling on volatility and start profiting from it.

Too many people are flying blind. They see a ticker pop up and think, “That’s the one!” They’re trading on hope and hype. That’s not a strategy; it’s gambling.

My team and I don’t guess. We have a repeatable process. A checklist. A system.

And it starts with a simple truth: You don’t find the perfect trade; you scan for opportunity.

This isn’t about some secret indicator or a black box algorithm. It’s about using what’s available to everyone and applying a simple filter to find what others miss.

Here’s how we find trades with high premium potential:

1. Price is the first filter. We’re not playing with penny stocks. We set a minimum price of $30. This filters out the noise and focuses our attention on liquid, established companies.

2. Volume is the second filter. We look for stocks trading at least one million shares a day. Why? Liquidity. If you can’t get in and out of a position, you’re not trading; you’re trapped.

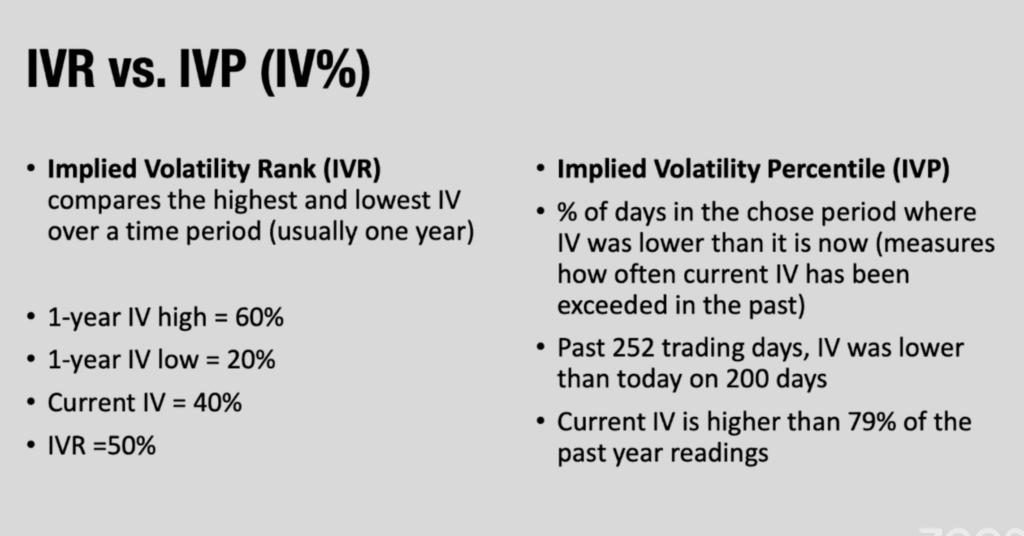

3. The Gold Standard: Implied Volatility (IV). This is where you find the money. High implied volatility means a higher premium for options. We use something called IV Percentile to see if a stock’s current volatility is higher than its historical average. This is your cue. We’re looking for stocks with an IV Percentile of 30% or more. This tells us the market is expecting a big move, and that’s an opportunity for us to collect premium.

4. The Exclusions. We intentionally exclude stocks with upcoming earnings reports. Why? Earnings are a coin flip. We’re not here to gamble on corporate announcements. We want to find trades where we have an edge, not a hope.

The output of this process is not a trade, but a lead. It’s a list of high-potential tickers. From there, we run each one through a final checklist to see if it meets our criteria for a setup.

This is the system. This is the playbook. It’s simple, repeatable, and gives you a massive advantage over the people who are just chasing headlines.

You want a winning trade? Stop looking for a shortcut and start building a system.

Watch The Full Deep Dive Here:

YOUR NEXT RECOMMENDED TRAINING: