Key Economic Reports

At the end of November, U.S. employers reported more job openings than expected.

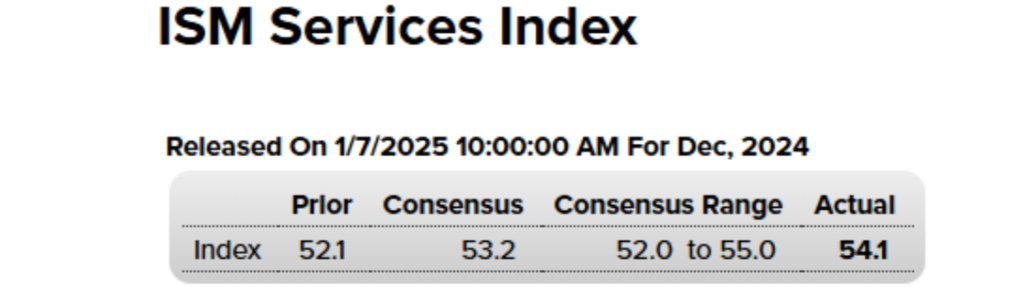

Additionally, December saw surprising growth in finance, retail, and other service industries. A rating over 50 indicates expansion so not only do we have a score over 50, but it increased from 52.1 to 54.1.

While these indicators push the recession narrative further out, they also raise concerns about inflation sticking around longer than hoped.

That inflationary pressure is a problem for the Federal Reserve, making them less likely to ease interest rates this year. To make matters worse, Tuesday’s report on U.S. service industries showed prices still rising in December. Add in chatter about new tariffs and potential tax cuts that could increase government debt, and it’s no surprise bond yields are climbing.

Why Rising Yields Matter

As bond yields rise, they become more attractive to investors, often pulling money away from the stock market. The 10-year Treasury yield jumped to 4.69%, up from 4.63% after Tuesday’s reports and significantly higher than the 4.15% levels seen in early December.

Higher yields also spell trouble for companies that rely heavily on borrowing. Rising rates increase the cost of capital, squeezing profit margins and forcing businesses to be more selective with investments. Tech stocks, often valued for their future earnings potential, tend to feel the pinch the most in such environments.

The Technology 100 (QQQ) tried to get back into the long-term trend channel after falling through the levels last week. This re-test and rejection is something we should keep a close eye on. We are back again to a support level, so we may be seeing the start of a sideways market if we can keep holding this support level.

What’s the Market Signaling?

The market’s reaction highlights a renewed focus on inflation and monetary policy. Investors appear to be re-evaluating expectations for 2024, pricing in the possibility that the Fed could hold rates higher for longer. Futures markets now suggest the first rate cut may not arrive until late in the year, a significant shift from earlier hopes of mid-year relief.

Meanwhile, volatility remains a key theme. The VIX, often referred to as the “fear gauge,” ticked higher this week, reflecting the market’s unease.

Earnings season is just around the corner, and with valuations already under pressure from rising yields, any negative surprises could amplify selling pressure.

What’s Next?

The focus will remain on key data points in the weeks ahead, particularly reports on consumer spending, inflation, and employment. If these continue to signal resilience in the economy, the Fed may have little incentive to ease up on its hawkish stance.

For investors, this environment underscores the importance of diversification and a cautious approach. Defensive sectors like utilities, healthcare, and consumer staples could gain favor as growth-oriented names face headwinds. Additionally, the bond market itself may become increasingly attractive as yields rise, offering safer alternatives to volatile equities.

Final Thoughts

Now that the summer fears of an economic slowdown have faded and the 10-year yield is firmly above 4.50%, the market seems to have entered a familiar “good news is bad news” phase. Strong economic data, while reassuring on the surface, is rekindling fears of inflation and tighter monetary policy.

For now, the tug-of-war between bulls and bears shows no signs of slowing, leaving traders and investors alike bracing for more volatility in the weeks ahead.