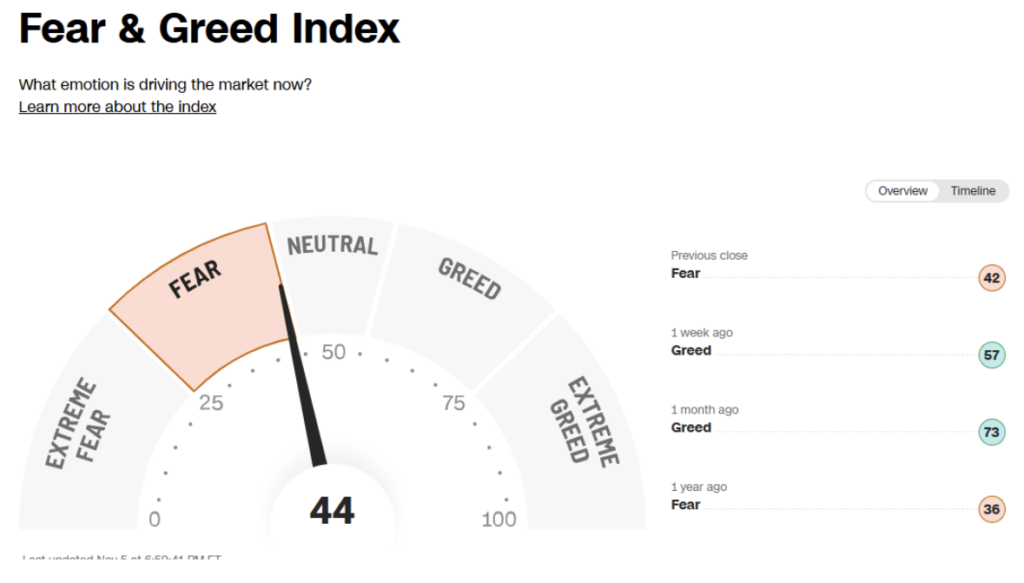

First up is the election, and we need to face that we may not know the results for several days if not weeks. One barometer of fear that has picked up in popularity is the CNN Fear & Greed Index. A month ago and even a week ago, the index pointed to Greed, but within the past week, the index dropped past neutral and went right to fear.

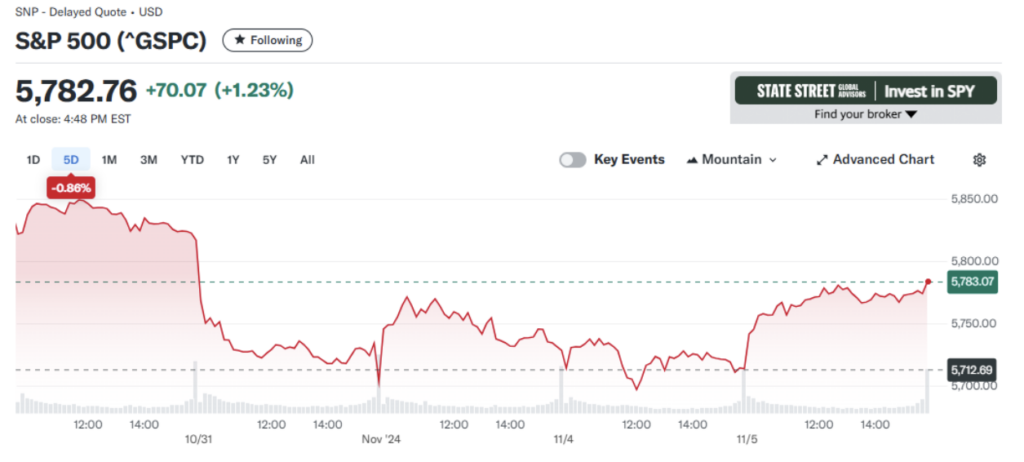

Prices in the S&P 500 somewhat reflect the change in mood, with the index dropping over the last five days, by nearly 1%. If you remove yesterday’s jump higher, we were looking at a 4-day loss of around 2%.

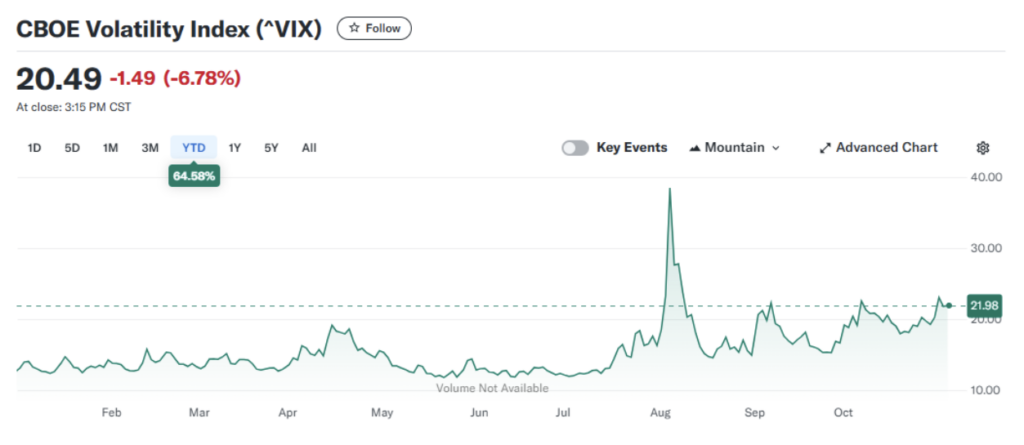

But what is interesting is that the Volatility Index (VIX) has remained relatively stable. The index is known to have wild swings and the last five days are no different. The index rose nearly 6% as shown here:

Even with a 6% increase in five days, the VIX is still nowhere near the August spike close to 40.

That would make it seem that investors have been cautiously optimistic about the events this week.

That brings us to a chart of the S&P 500. The index is trading at the same level it was in mid-September, so we didn’t have much of an October rally. At the same time, it wasn’t a turn-around October either. The long-term trend is still lower left to upper right on the chart and the index rallied hard off of the 50-day simple moving average.

While I’ve been cautious and on the sidelines leading up to this week, the price action around the trend line and the moving average suggests we have the potential to put the election behind us and resume the existing trend.

That said, one good day does not make a trend. I’d still like to see a strong close over $580 (SPY). If you’re a reversal trader, now may be the time to start looking for bottom stocks ready to take off to the up side.

Speaking of pullbacks, Gold (GLD) may be rounding out the bottom of the latest swing low and getting ready to move higher once again.

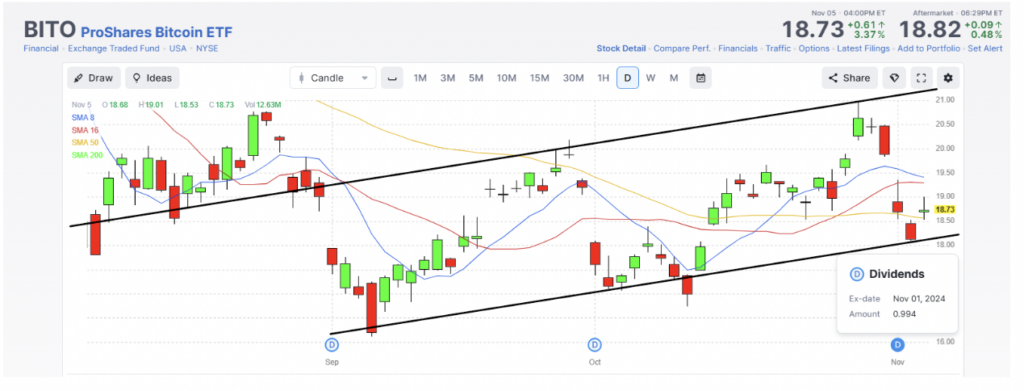

Last, but not least, is the ProShares Bitcoin ETF (BITO), which just returned a monthly $0.99 dividend on a $20 ETF. As a result, the underlying dropped in price, but looks to be heading back to the top of the trend channel, especially with Bitcoin rising in price.

Ok, that’s it for me today. We still have to tally the votes for the election and see what the Fed will do, so there should be plenty for us to review again on Friday. Until then, have a good day trading!