The latest round of economic data threw some cold water on the market rally and there’s a key piece of data causing the issue. It’s something that John writes about all the time and has been warning us about for the last year.

And that one data point is signaling an imminent recessionary bear market in the equities market.

Treasury yields ripped to new 2024 highs, confirming near-term uptrends into focus. The 10-year Treasury rates stand at 4.649% and are steadily rising. Ultimately this means more competition for stocks as an attractive alternative.

A higher 10-year treasury yield also weighs on the high-multiple shares of growth companies that are expected to generate more of their profits in the future – like tech companies.

It doesn’t help that the Fed essentially gave up on a June rate cut and July is no more than a 50-50 toss-up.

While equities have been pricing in a certain number of rate cuts to happen this year, they are now out of balance with what the Fed has planned.

In other words, equities rose on the assumption of events happening, and those events are looking less and less likely. That means equities are overpriced at current levels and are in a correction phase as a result.

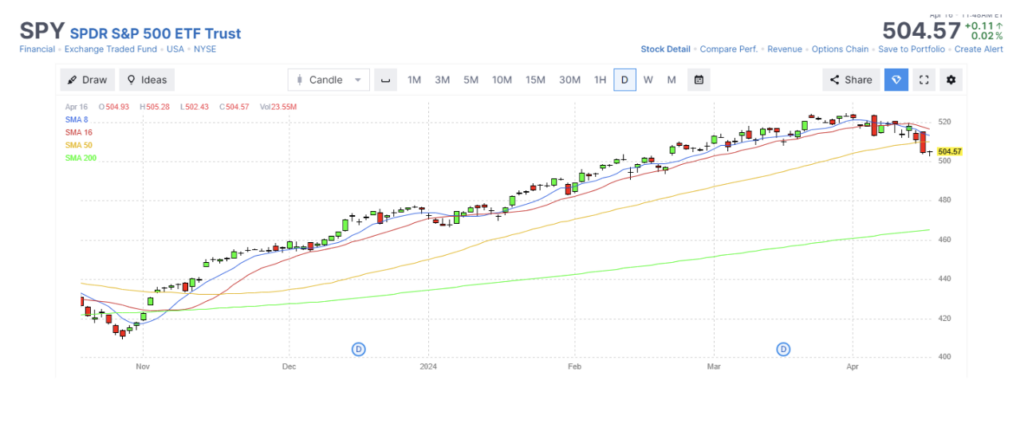

The broader S&P 500 broke down through the lower trend line and the key 50-day moving average (orange line in the chart below) and has struggled to recover.

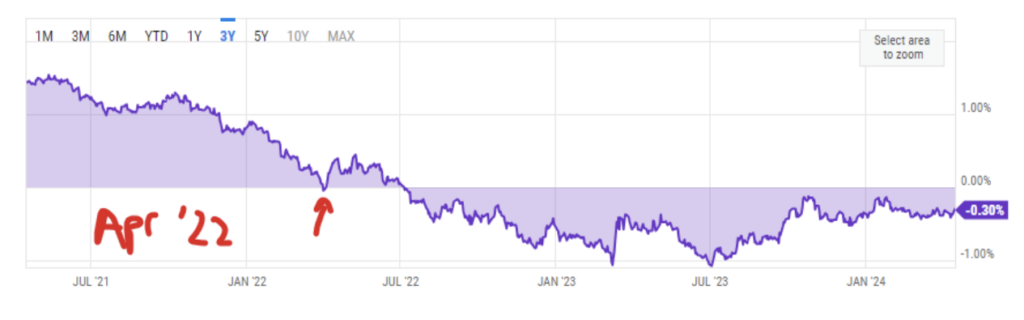

What’s interesting is looking back at the 10-2 Treasury Yield Spread. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period. A negative 10-2 spread has predicted every recession from 1955 to 2018, but has occurred 6-24 months before the recession occurred, and is thus seen as a far-leading indicator.

The 10-2 spread inverted back in April of 2022, and yes, this situation was different due to a global pandemic rather than a typical recession, but here we are 24 months later. Is this the start of a deeper pullback? Or has the recession already happened? Or maybe this is one time where the 10-2 spread doesn’t accurately predict a recession.

With earnings season kicking into high gear this week, you’ll see companies report beating estimated revenue numbers, but more CEOs will warn about future guidance with an unknown number of rate cuts on the table. Some might be posturing so the company can lower next quarter’s estimates and later beat them.

Either way, the technicals are breaking down from bullish to neutral, and the upcoming catalysts are likely bearish if CEOs keep pushing the lower guidance narrative.

All of that can change at a moment’s notice if inflation numbers improve and/or the Fed signals rut cuts ahead.

If you’re feeling a bit uneasy though, just remember that since 1950, the S&P 500 has had three 5% pullbacks per year on average, and only 40% of the time the S&P 500 has dropped 5-10% intra-year. We’re sitting just over a 3% pullback from all-time highs, so we might have already seen the majority of the current corrective phase and then back up we go.