Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

Markets are moving — but not always in ways that make the headlines. In this week’s Breakfast Club, we dug into the “silent shift” happening underneath the surface: the Fed’s next cut, surprising labor dynamics, sector rotations, and how businesses are quietly reshaping themselves with AI. If you’re positioning for Q4, this is what you need to know.

Quick Wins & Trading Momentum

We kicked things off with good news. It’s entry day for the Three Stock Strategy, and members received a new capital management model we’ve been working on. It’s a formula-driven approach designed to optimize position sizing — flexible enough that you can still use equal shares or equal capital, but sharper for those looking to fine-tune.

On the trading side, our ladder put spread on Google delivered profits last week, just like Netflix the week before. These short, midweek-to-weekend trades continue to prove their value. They’re a simple way to generate extra income while the bigger, slower market shifts play out.

Macro Signals: “Bad Data” Turns Good Again

From a macro perspective, the Fed is in focus. The market is now fully expecting a quarter-point cut in September, with growing talk of a half-point move — something you almost never see outside of a crisis.

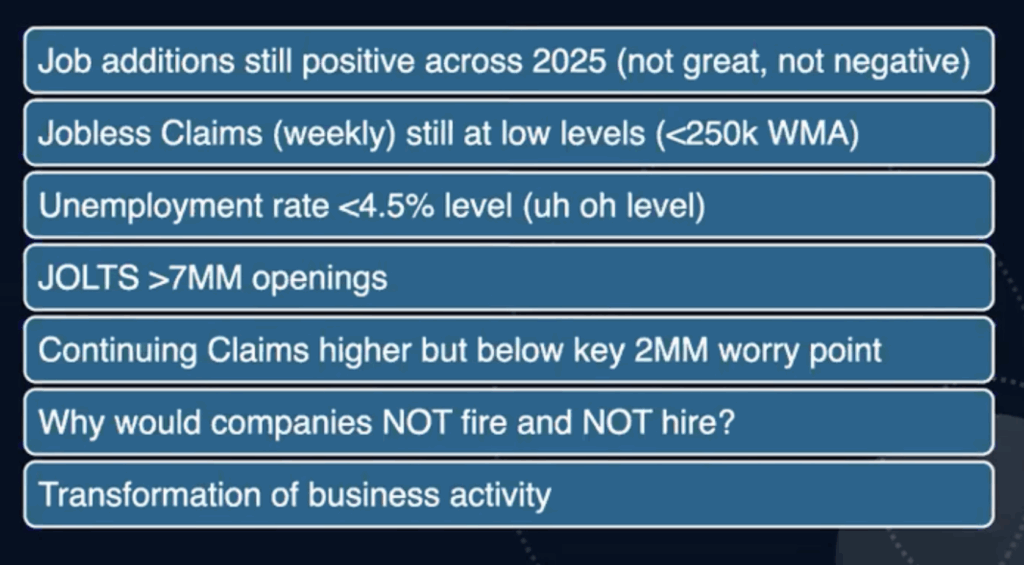

Economic growth remains steady. Services PMI is back in expansion, manufacturing is soft but holding, and GDP is keeping pace with expectations. Labor is where the story gets more interesting. Job growth is slowing but still positive, unemployment sits at 4.3%, jobless claims remain low, and there are still around seven million job openings.

The Quiet AI Transformation

Here’s where we think the real story lies. That slowdown in labor might not be weakness at all — it could be an artificial pause. Companies aren’t rushing to hire or fire because they’re testing something new: how AI can reshape productivity.

Think about it this way: in some cases, one worker plus AI tools can do the work of three. It’s the same kind of transformational moment we saw with Ford’s assembly line or the rise of robotics. And it’s happening quietly, right now.

That’s why we’ve been developing what we call AI² — not AI 2.0, but AI at the business layer. Instead of focusing only on the companies building chips and infrastructure, AI² is about businesses that are actually using AI to cut costs, gain efficiencies, and grow revenue. Our early work on this shows outperformance of more than five-to-one compared to the S&P 500 this year. We’ll officially launch the AI² Index in October during Millionaires Trading Club, but we wanted you to see where it’s headed.

Sector Rotations and Seasonal Shifts

We’re also watching rotation under the surface. On September 22, Robinhood, AppLovin, and Morre Energy will be added to the S&P 500, which will drive index fund buying. AppLovin in particular is a perfect example of how AI² shows up in the real world — it’s already using AI to revolutionize ad creation and testing.

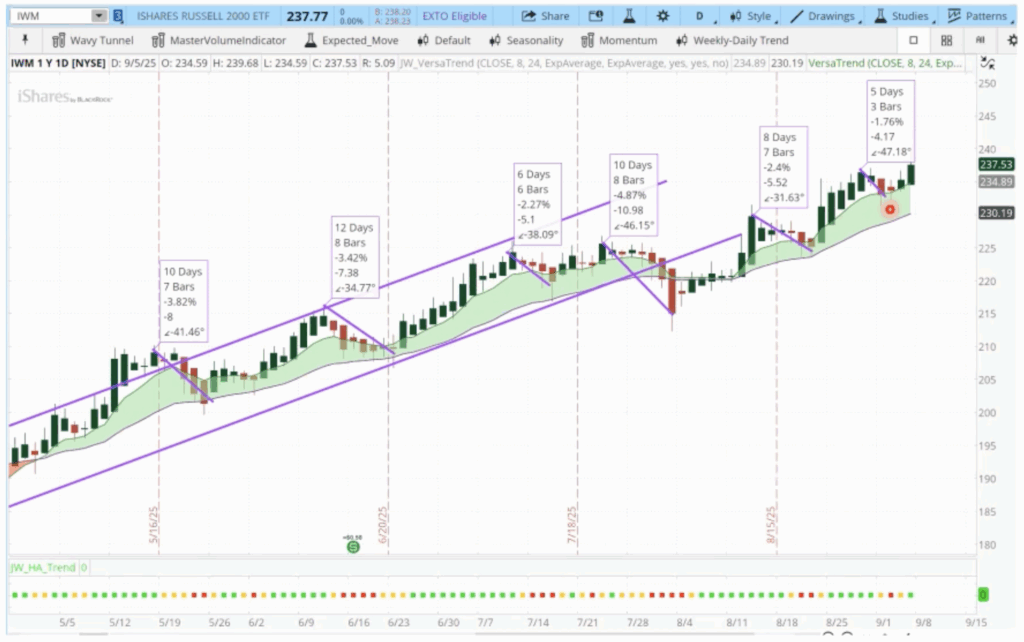

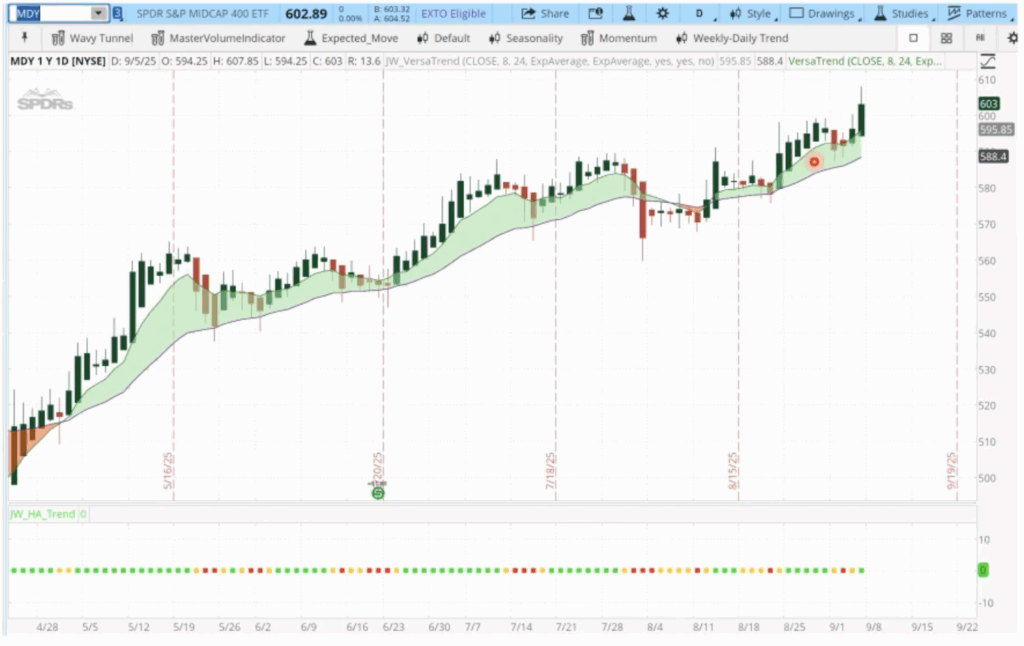

Breadth across the S&P 500 is improving, with more than half of stocks above their 20-day moving averages. Utilities, though, are deeply oversold — a level that often signals opportunity. Meanwhile, midcaps and small caps are trending stronger, even as some mega-caps like Nvidia and Microsoft are pausing. Google, however, continues to shine.

Seasonality also matters here. September often stumbles early, but historically flips stronger mid-month and keeps building into October, November, and December. That sets the stage for what could be a very strong Q4.

The Bottom Line

The most important changes aren’t happening in headlines. They’re happening quietly — in how companies use AI, in how capital rotates into overlooked sectors, and in the way seasonality lines up into year-end.

This is the silent shift we’re watching. And if you position for it now, you’ll be ready to capture the upside when it moves into full view.

We’ll be back Wednesday morning at 8:30 AM EST on “Breakfast Club Live” with more market insights. But don’t wait. Watch the full video now to see the strategy in action.

Ready to see how we apply this knowledge to our trades? Join our trading community and get access to the tools, data, and strategies that are helping us win week after week. Join Traders Reserve today.