Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

The Weekly Income Report: What Our Traders Are Doing

Last week was a perfect example of what smart trading is all about: managing risk, taking calculated losses, and letting the winners run. Across our trading services, our traders generated some impressive returns despite a few bumps along the way.

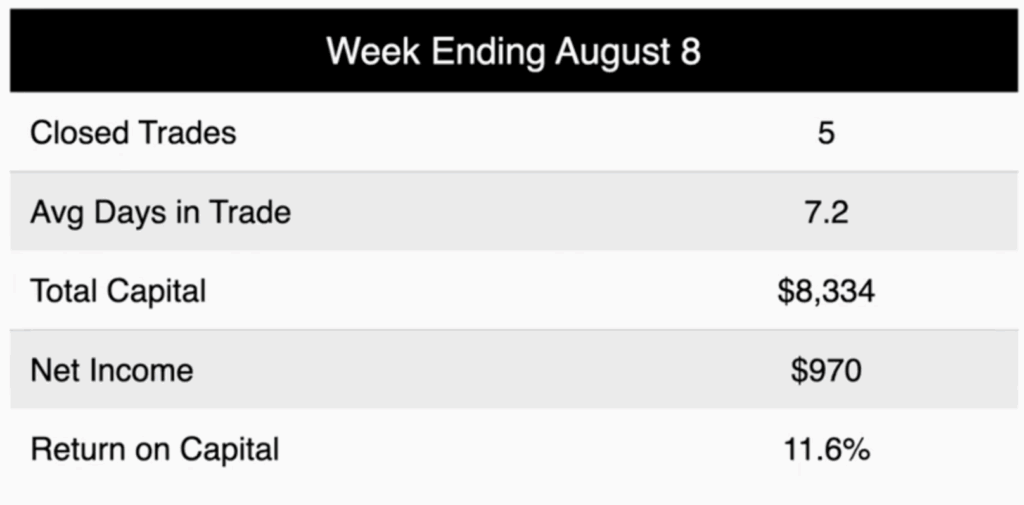

Income Masters: Our Income Masters traders had a fantastic week, closing 5 trades and generating $970 in total income on just $8,334 in capital. That’s an incredible 11.6% return for the week. The average trade lasted only 7.2 days, demonstrating the power of our short-term, high-probability strategies. We’re gearing up for our “Income Madness Week” next week, where the objective is to pull $2,500 or more in cash out of the market in 2 to 7 days.

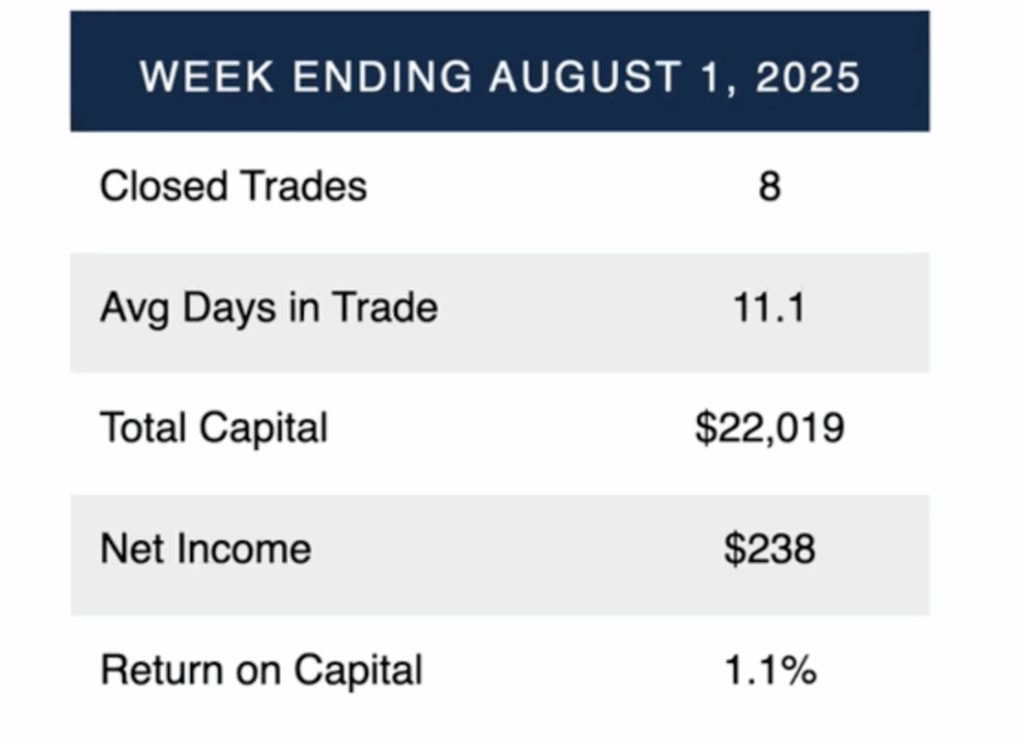

Millionaires Trading Club: Our Millionaires Trading Club traders closed 8 trades, but not all of them were winners. We took two losses: one on a small $400 loss on Advanced Auto Parts and another on an Apple bear call spread. The Apple loss was a particularly tough one, as the stock made a highly unusual 100%+ ATR move for three straight days. However, thanks to our disciplined approach and the volume of our winning trades, our traders still ended the week with a positive return of 1.1% on over $22,000 in capital, for a total profit of $238.

This is a perfect example of why you cut your losses and move on—our system is designed to absorb these hits and keep moving forward.

The Market Is Lying: Why the S&P Rally Is a Trap

While the S&P 500 gained 2.43% last week, you need to look closer. The rally was driven almost entirely by a handful of mega-cap stocks like Apple, which shot up on what many consider to be a “bad news is good news” narrative. A look at the equal-weighted ETF shows a much different story, with the broader market not recovering nearly as much. This is a red flag.

The core economic data paints a concerning picture:

- Services PMI: The key Services PMI fell to 50.1, teetering on the edge of contraction. Every single component was negative, a cause for serious concern. This is a clear signal of an economic slowdown.

- Stagflation Risk: Even more alarming, “prices paid” have spiked dramatically in the services sector. When you combine negative growth with positive inflation, you get stagflation. This is a nightmare scenario that the Federal Reserve is not equipped to handle with its current policy.

- Unemployment Claims: We’re watching continuing claims for unemployment closely. If they rise above 2 million, it becomes a major problem for the labor market and consumer spending.

This market is at a crossroads. The Fed is aiming for a “soft landing,” but the data suggests it could be a bumpy ride. This is not the time to be reckless; it’s the time to be disciplined.

Our Free Trade Idea of the Week: This Stock Could Double Your Money

Finding a great trade isn’t about luck; it’s about following a repeatable process. This week, we found a high-potential opportunity that came across our screen: Vital Farms (VITL).

Here’s why we’re watching it:

- Massive Volume Spike: After its recent earnings report, the stock saw a volume surge of over 300% above its average. This is a powerful signal of institutional interest and a potential change in trend.

- Bullish Moving Average Crossover: The 10-day simple moving average crossed above the 30-day simple moving average, and both are now trading above the 200-day simple moving average. This is a classic bullish setup.

Our technical analysis suggests a target price of around $50. A long options trade on this could potentially return 200% on your investment if the stock moves quickly.

We’re also tracking our Netflix long-term thesis, which continues to show strength as the stock recently popped 4.5% last week.

We’ll be back Wednesday morning at 8:30 AM EST on “Breakfast Club Live” with more market insights. But don’t wait.

Don’t wait for permission to win. Join our trading community and get access to the tools, data, and strategies that are helping us win week after week. Join Traders Reserve today.