Inflation Eases, but Is It Enough?

The latest CPI and PPI reports indicate that inflation is moderating, offering some relief to investors worried about persistent price pressures.

It started Wednesday with the Consumer Price Index coming in under the consensus amount in every area. That showed that consumer prices are coming down, which is great for inflation and for the Fed to consider lowering interest rates.

Then came the Producer Price Index. Similar to the CPI report, most of the numbers came in under the consensus. A few months ago, we would have loved to see a print like this. The market might have skyrocketed 1% or more. Sadly, we’re no longer in that type of environment.

On the surface, this lower-than-expected inflation print should have been bullish for equities. Cooling producer prices could translate to lower future consumer inflation, potentially easing pressure on the Fed. However, this optimism was overshadowed by a more immediate concern: escalating trade tensions.

Market Breakdown: Indices Tumble

The broad-based decline reflects growing uncertainty over trade policy and corporate earnings revisions, as well as potential near-term economic headwinds.

Over the last month, there have been very few green days. The S&P 500 entered into correction territory and is temporarily oversold, but oversold indicators don’t mean the market is going to turn around right now. Oversold doesn’t mean the trend is over.

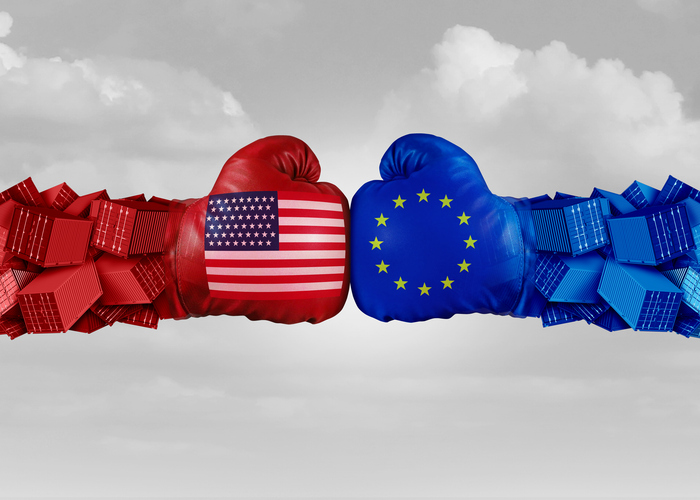

Trade War Fears Rattle Markets

President Trump’s new threat of a 200% tariff on European wine and cognac imports sent shockwaves through the markets. This came in response to EU surcharges on U.S. whiskey, raising fears of a full-blown trade war with Europe. The uncertainty surrounding global trade policy weighed heavily on equities, particularly sectors reliant on international commerce.

Sectors in Focus: What’s Holding Up?

While most sectors sank, a few showed resilience:

- Gold Mining: As a safe-haven asset, gold surged toward $3,000/oz, lifting Newmont (+4.6%) and other miners.

- Telecom: Verizon managed to eke out gains amid defensive sector rotation.

- Discount Retail: Dollar General rose on strong earnings, showing demand resilience.

On the flip side, technology was the biggest loser, with Adobe (-13.8%) taking a hit after issuing weak guidance. Semiconductors and consumer tech stocks also fell sharply.

Technical Watch: Broadening Triangle and RSI Warning

The S&P 500 has been trading in a broadening triangle pattern, marked by higher highs and lower lows, making clear support and resistance levels harder to define. The 5,940 level has acted as a key pivot, drawing the index back from both extreme highs and lows. This “magnetic” effect suggests that any near-term rally could stall at this level, making it a critical resistance point.

A bigger red flag is the weekly RSI divergence, which historically has preceded major market downturns. The weekly RSI fell below 50 last week, a technical signal last seen in early 2022 before that year’s bear market. Similar patterns were observed before the Tech Bubble crash, the 2008 financial crisis, and the 2018 selloff. If this signal holds, further downside could be on the horizon.

The Fed Factor: Will Rate Cuts Come Sooner?

With inflation trending lower but still above the Fed’s 2% target, markets are now pricing in 2-3 rate cuts in 2025. The Fed will likely wait for more confirmation before shifting policy, but yesterday’s PPI miss increases the odds of a rate cut by mid-year. However, persistent wage inflation and strong consumer spending may complicate the timeline.

What’s Next?

Key levels to watch:

- S&P 500: Support at 5,400, resistance at 5,650

- Dow: Watch for 40,500 support, 41,000 remains a psychological hurdle

- Nasdaq: 17,200 key support level

In the short term, expect continued volatility as investors digest economic data, Fed policy expectations, and trade war rhetoric. Opportunities may lie in safe-haven assets like gold and defensive stocks, while growth stocks could face headwinds.

Bottom Line: The combination of easing inflation and rising trade tensions has created a push-pull effect in markets. Stay nimble and closely monitor policy developments, as any shifts could dictate the next big market move.

If CPI and PPI can’t lift the markets, maybe the Quantum Computing and AI Conference, which will be held March 17-21, might showcase something that can. Nivida (NVDA) CEO Jensen Huang will speak on March 20th.

In the meantime, stay safe out there. I will see you next week where the market over the last 10 years has typically seen a seasonal bump higher. Hopefully, that’s the case this year.