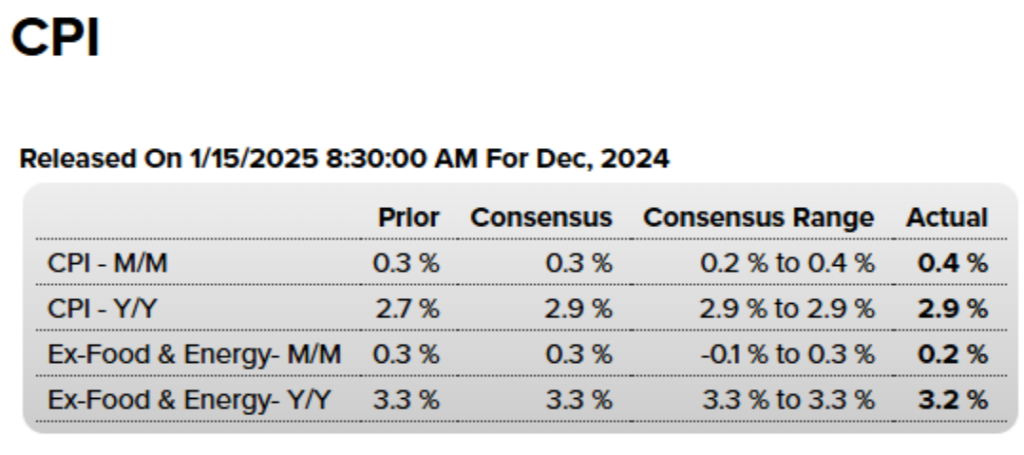

December CPI: Mixed Signals for Inflation

The Bureau of Labor Statistics revealed that consumer prices rose 2.9% year-over-year in December, a slight uptick from November’s 2.7% increase. Much of the rise was driven by higher energy costs, particularly gasoline prices, as global energy markets remain volatile. On the other hand, core CPI, which excludes food and energy, showed more promising signs, edging down to 3.2%—just below analysts’ expectations of 3.3%.

This dual narrative leaves investors with questions about the Federal Reserve’s next steps. While moderating core inflation might signal that rate hikes are taking hold, the upward pressure from energy prices complicates the picture. For now, the market expects the Fed to tread cautiously, with some speculating on potential rate cuts later in the year if inflationary pressures subside further.

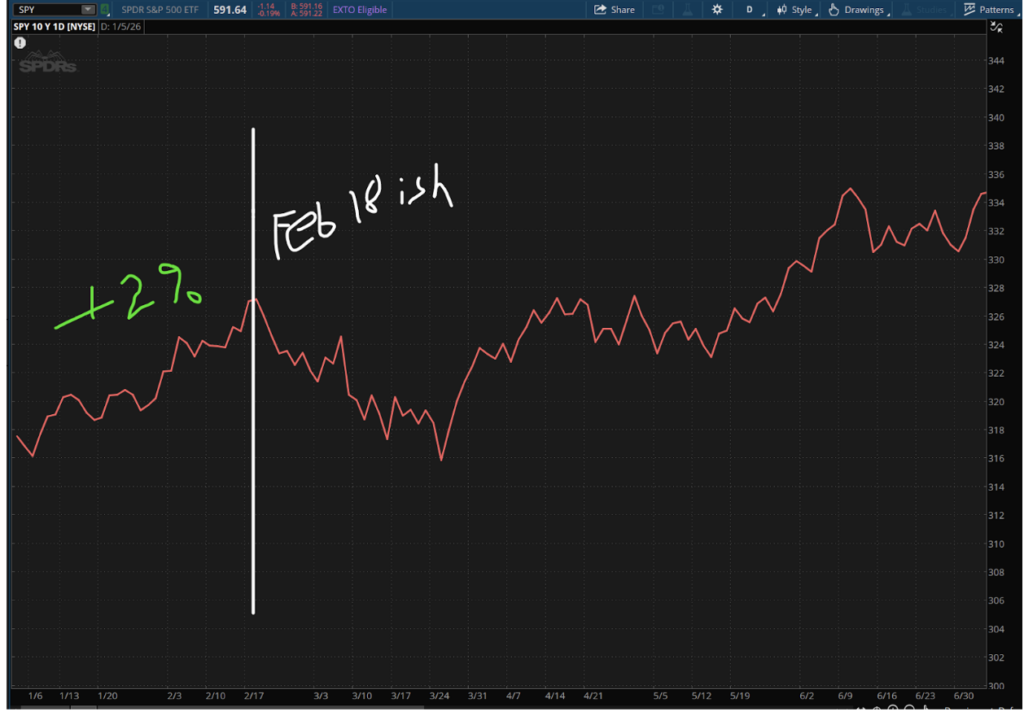

That little 0.1% difference in Core CPI between expectations and actual inflation sent the market skyrocketing. Once the market filled the election gap from November 5th, it changed its momentum. Yes, yesterday was a down day, but not surprising after Wednesday’s move higher. As shown in the chart, there’s still plenty of room for the market to move higher and test its previous resistance area.

Bank Earnings: Resilience Amid Challenges

Meanwhile, the fourth-quarter 2024 earnings season kicked off with strong results from major financial institutions, signaling resilience in the banking sector. Highlights include:

- Bank of America (BAC): Posted earnings per share (EPS) of $0.82, surpassing the consensus estimate of $0.77. The bank also reported a 15% year-over-year increase in revenue, reaching $25.3 billion, driven by higher net interest income as a result of elevated interest rates.

- Morgan Stanley (MS): Benefited from a resurgence in dealmaking activity, which boosted revenue and led to a 1.6% rise in stock price following the earnings report. This was a welcome relief after several quarters of subdued investment banking activity.

- Taiwan Semiconductor Manufacturing Co. (TSMC): Although not a traditional bank, TSMC’s results underscore broader economic trends. The company saw strong demand for artificial intelligence applications, driving a 5.8% surge in its stock price and reinforcing the strength of tech-adjacent sectors.

One caveat for the banking sector: several firms reported rising loan loss provisions, a sign that they are preparing for potential economic turbulence. This cautious approach suggests that while the present environment remains favorable, the industry is bracing for potential headwinds.

The Financial ETF (XLF) helped lift the markets earlier in the week. The ETF could go higher as more banks release earnings next week. The XLF is sitting at a resistance zone, but could easily climb higher to $51.50 to challenge previous highs.

Market Reaction and Investor Sentiment

The markets responded to these reports with a mixed tone. The S&P 500 slipped 0.2%, the Dow Jones Industrial Average fell 68 points, and the Nasdaq Composite dropped 0.9%, as tech stocks weighed on the broader indices. The Volatility Index (VIX) also ticked higher, reflecting lingering uncertainty around inflation and monetary policy.

While the slight rise in headline inflation caused some concern, the decline in core CPI offered a glimmer of hope that the Federal Reserve’s tightening measures are working. As a result, investors are weighing the potential for rate cuts later in the year, even as caution remains the prevailing sentiment.

What Lies Ahead?

Over the last 10 years, the S&P 500 has moved an average of 2.07% over the next five weeks, getting us to around February 18th. With strong earnings coming out of the banks, we could easily see the market fulfill its seasonal pattern before taking a breather.

Of course, we don’t know what the inauguration will bring on January 20th. We will finally get to see what ideas will be placed into action.

Stay tuned for more updates as we break down key earnings reports and economic trends in the weeks ahead.

Remember, the market is closed on Monday so adjust any positions accordingly.

Have a good weekend!