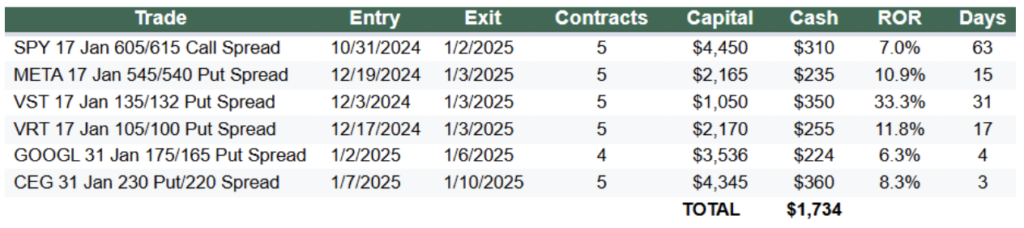

We started the new year off with a flurry of closeouts at Traders Reserve. In the first two trading days of 2025, we exited 13 trades across our services, netting more than $4,700 in cash.

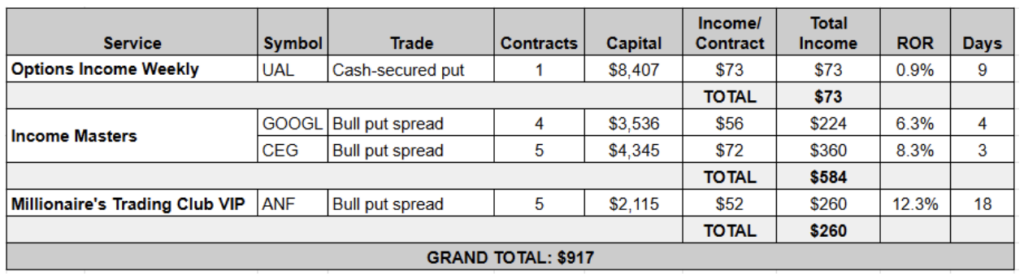

The first full week of January was slow by comparison, but we still booked over $900 from four winning trades.

Here are all of the closed trades from the week of Jan. 6-10:

Last week’s slower pace was due in part to the market being closed on Thursday for a national day of mourning for former President Jimmy Carter.

This meant we did not place our usual SPX1 trade. That turned out to be lucky, as the S&P 500 plummeted on Friday after the December jobs report released before the bell pointed to a strengthening labor market.

The U.S. economy added 256,000 jobs last month, well above the 155,000 economists were forecasting. What’s more, the unemployment rate decreased to 4.1% from 4.2%. This practically guarantees the Federal Reserve will not lower rates in January.

And even though just one day prior to the jobs report the Fed Funds futures showed a 93.6% chance that rates would remain unchanged at the next FOMC meeting, investors still sold the news. The major indices all fell more than 1.5% on Friday.

But not all stocks declined, and we happened to be trading one of the day’s biggest winners in the Income Masters program. As you may have guessed, that is the trade we’ll be looking at a bit closer this week.

Constellation Energy (CEG) is a leading supplier of energy products and services in the United States. This includes electricity and natural gas, as well as sustainable energy sources such as solar power and nuclear energy. It serves nearly 2 million residential, public sector and business customers across the country.

Utility stocks are typically steady gainers, as demand for their services generally remains stable regardless of economic fluctuations. What largely drew us to Constellation Energy, though, was the opportunity for the company to supply big data centers, which power everything from AI to cloud computing and e-commerce.

We highlighted CEG on a list of stocks we planned to trade in Income Masters in 2025, along with some other utility and data center services plays like Vertiv Holdings (VRT) and Vistra Corp. (VST), both of which we have traded successfully before.

In fact, we traded data-center systems specialist Vertiv 19 times in Income Masters in 2024, making it our most-traded stock of the year. All of those trades were profitable, including some earnings plays that we closed in less than 24 hours and a longer-term trade that wound up being our highest-earning Income Masters position of the year. All told, we earned a combined $4,656 in profits from VRT last year.

But back to CEG, which is the focus of today’s Weekly Income Report.

As you can see in the chart below, the stock has moved up strongly over the past year. Even before Friday’s big move, shares were up roughly 110% over the past year and 9% in 2025.

Much of this strength is due to bullish sentiment around nuclear stocks, as Big Tech looks to them to power artificial intelligence applications. These alternative energy stocks offer traders another way to play the biggest investing trend since the arrival of the internet. And we’ve been cashing in on them as well as on more traditional AI stocks.

While utilities are not generally big movers, just one week prior we exited a position in Vistra, which owns four nuclear facilities, after the stock rallied 8.5% in a single day, causing our bull put spread to hit its target exit price. But that pales in comparison to what we saw with CEG.

We recommended our first trade in CEG during the Jan. 7 Income Masters Live Trading Session.

With shares trading at $255.83, we used a bull put spread strategy to reduce our capital requirement and boost our potential rate of return.

Specifically, we sold the CEG 31 Jan 230 Put and bought the CEG 31 Jan 220 Put for a net credit of $1.31, or $131 per spread. We traded five contracts, generating $655 in cash upfront with a $4,345 capital commitment ($1,000 per 10-wide spread x 5 contracts less the $655 in premium).

At the time we entered the trade, we set a target exit price at $0.60, recommending that members place a good ‘til canceled (GTC) order to exit the trade at this level. In other words, we were targeting about 55% of the max profit from this trade.

We also told members that it was possible that the GTC could take longer than usual to fill, given that utility stocks are not typically highly volatile.

Yet, on Friday, CEG shares shot up more than 25%. Behind this move was news that the company plans to buy natural gas and geothermal electric utility Calpine Corporation for $16.4 billion.

Often when companies merge, shares of the company being purchased rally while the acquiring company’s stock falls due to concerns about the potential costs and risks associated with the merger, particularly if it’s perceived the price paid for the target company was too high.

Calpine, however, is privately held. When a public company buys a private one, shares of the acquiring company may rise if investors view it as a positive sign, especially if the deal is considered strategically beneficial. With the merger, Constellation says it will become the country’s largest clean energy provider and the biggest electric utility, with 2.5 million customers.

The stock gapped up on the open and our GTC was triggered one cent below where we placed it, allowing us to exit our spreads at $0.59 apiece. This gave us a profit of $72 per spread. And since we traded five contracts, our total profit was $360 for an 8.4% return in just three days.

Now, obviously, with a move like the one CEG experienced on Friday, we could have exited the trade at a much larger profit had we not had a GTC in place. But there was no telling that the stock would shoot up like this.

Given the current market environment, we’ve been refining our trading tactics in Income Masters. One of those refinements has been the use of tighter exit prices, targeting 40% to 60% of max profit, which is already paying off.

CEG marked our sixth winning trade of 2025 in the Income Masters program. That’s almost one per trading day so far in the new year! From those six trades, we’ve already netted more than $1,700 in year-to-date profits in the live account.

We expect the cash to keep rolling in as we kick off our first round of Income Madness for 2025 later today. We’ll keep you posted on those results, as well as the results from our other services, in the weeks ahead.