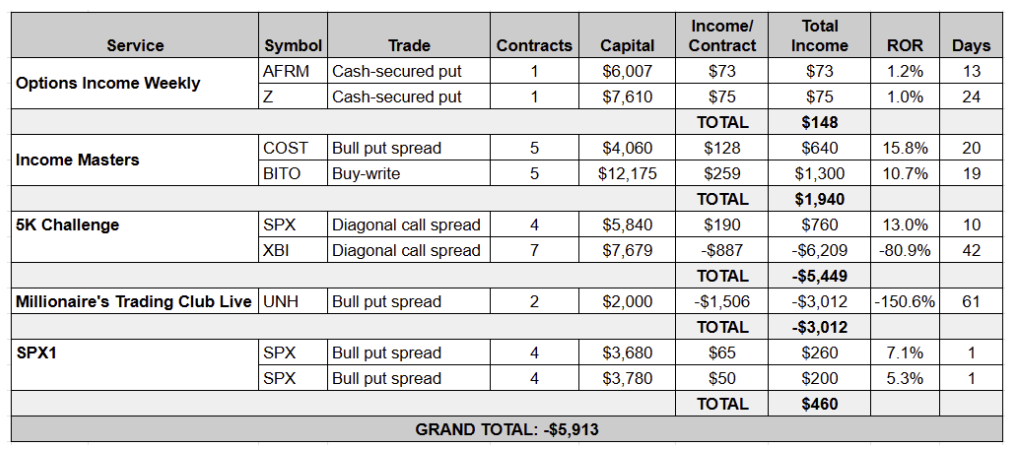

We closed seven winning trades last week but also decided to cut our losses on two trades that ended up putting us in the red. Here are all the closed trades from the week of Dec. 16-20:

Last week’s two losing trades were large ones, so let’s quickly review them before we take a closer look at one of our profitable trades that generated a number of member questions.

First, we ran into a string of bad luck with our UnitedHealth Group (UNH) position from the Millionaire’s Trading Club Live event in Las Vegas, getting caught on the wrong side twice.

First, the post-election bull run pushed our bear call spread into the money, prompting us to close the position and open a new bull put spread to reduce our debit. Then the stock began to slide following the shooting of the UnitedHealth CEO, which has prompted calls for large-scale reform to the U.S. healthcare system.

After members were assigned on the short put, we decided to shut down the trade, issuing an alert to sell shares and close the long put for a profit that reduced our overall loss on the position.

We booked a loss of roughly $3,000 on two contracts. However, we still have over $6,000 in cash in hand from that event with one position left open.

Then there was the SPDR S&P Biotech ETF (XBI) diagonal call spread from the 5K Challenge program. While we reset a handful of trades in the technology sector in anticipation of continued upside, the biotech ETF has been unable to gain any bullish traction.

We had high hopes for this position initially, but we ended up booking a loss of roughly $6,200 on seven contracts. Ouch. It’s important to keep in mind, though, that the 5K Challenge program targets large cash returns, often by trading a higher number of contracts than we do in our other services. This helps to amplify our profits, but also results in the occasional larger loss. However, in looking at our results since launching the service in mid-June, we are still up more than $9,500 even factoring in the XBI loss.

While taking losses is part of trading, it is never fun and not something we take lightly. When we decide to shut down a position rather than continuing to manage it, please know that it is because we do not think it’s salvageable and/or we think there are better opportunities for traders’ capital.

Speaking of good uses for traders’ capital, let’s look at a recent strategy we’ve been using with the ProShares Bitcoin ETF (BITO) to generate a lot of income.

BITO, the first bitcoin-linked ETF to trade in the US primarily invests in bitcoin futures, as opposed to the cryptocurrency itself. Whatever your thoughts on bitcoin, what’s interesting about BITO is that it pays a monthly dividend to shareholders, totaling $12.93 over the past 12 months for a nearly 47% yield.

That’s a nice chunk of cash, but as income traders, we take it one step further. The idea is to buy shares of the bitcoin ETF ahead of the ex-dividend date with an eye toward capturing the generous monthly payout while also selling a call option to collect additional premium.

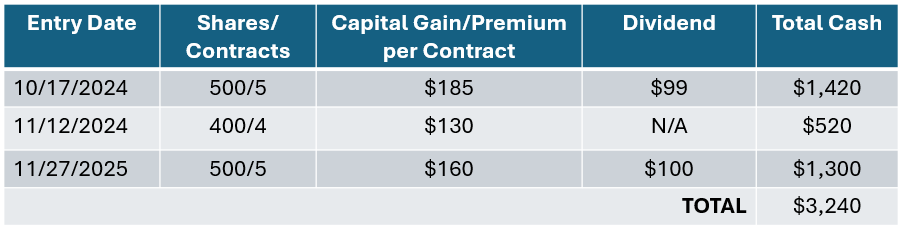

We debuted this strategy at the Millionaire’s Trading Club Live event in October, netting $1,420 on 500 shares, including the Nov. 1 dividend, for a 16% return in less than a month.

We traded BITO again in mid-November, this time in the Income Masters program, buying 400 shares and selling a call that expired just before the next ex-div date on Dec. 1.

Bitcoin continued to surge to new highs following the election, with the market anticipating a more crypto-friendly stance from the government. With our shares likely to be called away, we decided to close the position early, booking a $520 profit for a 5.7% return in eight days.

One week later, on Nov. 27, with bitcoin again climbing toward the $100,000 mark, we entered a new buy-write trade. This time, we purchased 500 shares around $25.95 apiece and sold five contracts of the BITO 20 Dec 27.50 Call for $0.61 each.

While our goal was to capture the $1 per-share December payout, we noted at the time that even if our shares were called away before the ETF’s Dec. 2 ex-dividend date, we would still get to keep the $0.61 call premium and earn $1.55 in capital appreciation in a matter of days.

But BITO remained below our $27.50 call strike heading into the ex-div date and we ended up securing the $1 per-share payout. Two weeks later, though, the ETF was trading at $27.72 as President-elect Donald Trump reaffirmed support for a U.S. bitcoin strategic reserve, and we issued an alert to close.

This decision generated some questions from members who wondered why we didn’t hold the position through expiration, so let’s look at the math.

By buying back our call and selling shares on Dec. 16, we netted a profit of $1.60 per contract. We also collected a $1 dividend, bringing our total profit to $2.60. And since we bought 500 shares and sold five contracts of this call in the live account, our total profit was $1,300.

Now, had we held on in hopes our shares would be called away on Dec. 20 at $27.50, we stood to potentially make $2.16 plus the $1 dividend, or $3.16. So, by closing early, we collected 82% of the max profit.

What’s more, bitcoin sold off heading into the end of the week after the Federal Reserve said it expects fewer interest-rate cuts next year and Fed Chair Jerome Powell dismissed the idea of the U.S. central bank holding the cryptocurrency.

BITO closed the week at $24.72, meaning our shares would not have been called away. By closing early, we removed this risk, pocketed $1,300 in cash and freed up over $12,000 in capital that we put to use with other trades.

If you are bullish on bitcoin long term and want to hold shares rather than moving in and out of trades as we are, you could. But you must be able to stomach the volatility that comes with that approach.

But we view BITO as a trading vehicle rather than a long-term play and will continue using short-term call options to collect cash while limiting our risk. So far, we’ve used this strategy to earn $3,240 on BITO since mid-October.

We will look to enter a similar trade this week or early next week ahead of the ETF’s next ex-dividend date. And we’ll continue with this strategy until we have a good reason not to.