For many, Friday the 13th conjures images of bad luck and superstition. But what if it’s not the unluckiest day for your portfolio? Historically, the S&P 500 (via SPY) has delivered some surprising results on this ominous date. From impressive gains to modest dips, Friday the 13th has its own unique story to tell in market lore. Could this notorious day actually be an overlooked opportunity for investors? Let’s dive into the data and uncover what the market’s fear factor really looks like.

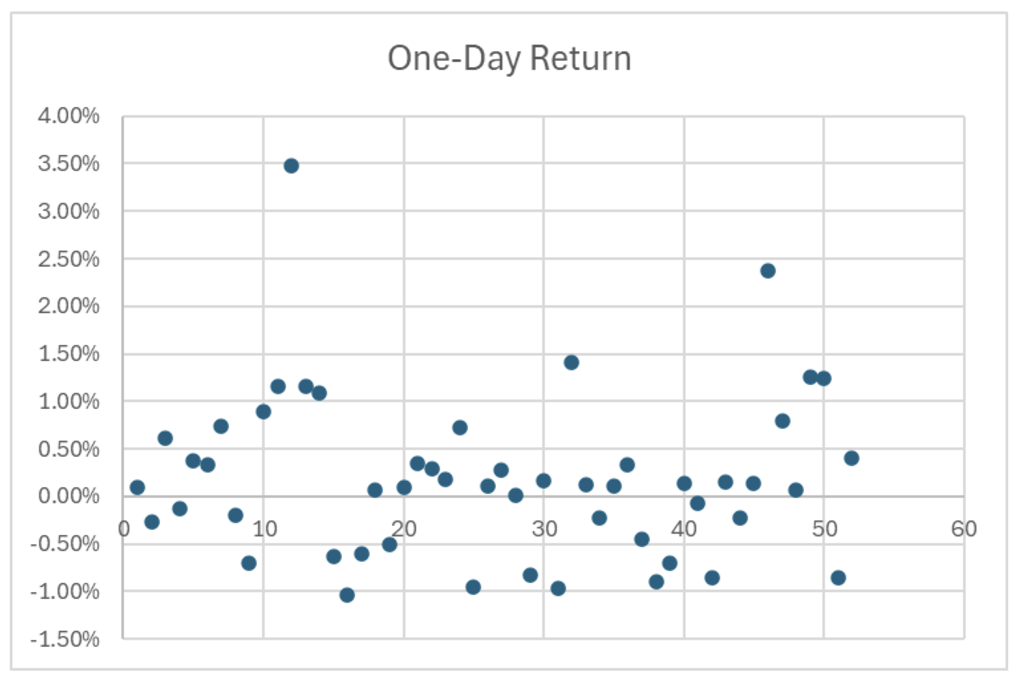

The numbers tell an interesting story. Historically, Friday the 13th has been a mixed bag for SPY, but the average return is modestly positive at 0.187%. Here’s what I found out when I poured through the data:

On average, the returns lean slightly positive. But like any trading day, the devil is in the details—or in this case, the trends.

There were 52 instances of Friday the 13th. Out of these:

- 33 were winning days (positive returns).

- 19 were losing days (negative or zero returns).

Win Rate

Historically, Friday the 13th has been more likely to be a winning day for the SPY, despite the superstitions surrounding the date.

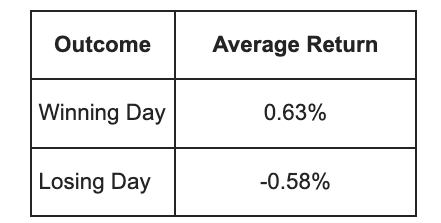

Here’s the analysis of the average returns for winning and losing Friday the 13th dates:

- Average Winning Day Return: Approximately 0.63%

- Average Losing Day Return: Approximately -0.58%

Summary Table

This table shows that on average, the winning days on Friday the 13th have a return of 0.63%, while the losing days have an average return of -0.58%. This indicates that the positive returns tend to be slightly higher than the negative returns on these dates.

Biggest Highs and Lows

Highest Return: On October 13, 2000, the SPY climbed 3.48%.

Lowest Return: On June 13, 2003, SPY dropped by 1.04%.

Recent Years

What about during the pandemic? On March 13, 2020—during the height of market volatility at the onset of the COVID-19 pandemic—SPY managed a 2.37% gain.

More recently, September 13, 2024, saw a 0.41% uptick. These days prove that Friday the 13th doesn’t have to be unlucky even in turbulent times.

Today

That brings us to today’s market. The market had a hard time digesting the news that producer prices rose more than expected, despite yesterday’s report showing consumer prices stayed in line with expectations. The market is in a sideways consolidation pattern, but it is hovering around its 10-day moving average, which has acted mostly as a line of support in the last few months.

Should this Friday the 13th bring its average drop, we’re talking about the SPY heading down to about 600, which would be right at the black horizontal support line drawn at the top of the previous swing high. I’m certainly looking for one of those positive Friday the 13th trading days instead!

Breaking Down the Myth

For traders, Friday the 13th is just another day to look at the data, manage risk, and execute strategies. Superstition may give the day a bad rap, but history shows there’s no need to avoid the market. In fact, with its slightly positive average return, Friday the 13th might even be considered a good omen for SPY.

Conclusion

I don’t know what today will bring, but next time Friday the 13th shows up on the calendar, don’t let superstition cloud your strategy. Look at the trends, trust the data, and remember—the market’s not afraid of a little bad luck. And neither should you be.