Last week I had the pleasure of meeting and engaging with traders from around the country at our Millionaire’s Trading Club event in Las Vegas. Earnings season was just beginning and we had the opportunity to trade live over three days.

Two common strategies we like to use during earnings are the Long Straddle and the Bull Put Spread, each offering unique benefits and risks depending on your outlook for the stock and how you want to manage volatility.

Emily did a wonderful write-up on the Long Straddle in the previous article. Here’s a quick recap.

The Long Straddle: Betting on a Big Move

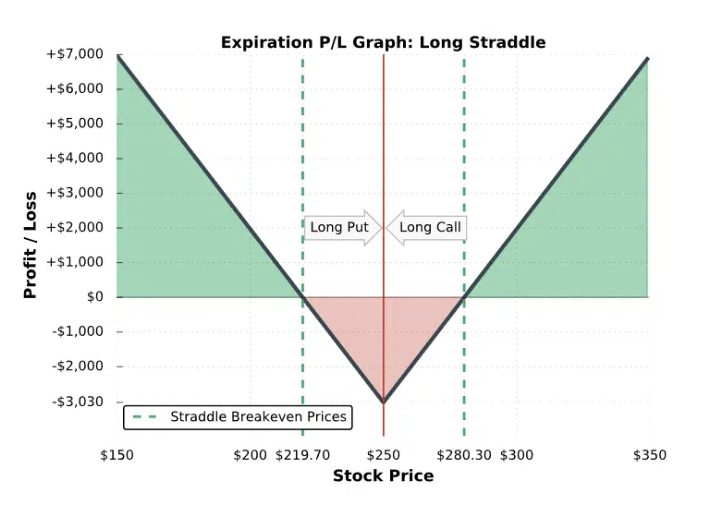

A long straddle is a non-directional strategy where you buy both a call option and a put option at the same strike price, typically at-the-money (ATM), with the same expiration date. The logic behind this trade is simple: you expect the stock to make a big move after earnings, but you aren’t sure in which direction.

The idea is with a big enough move in either direction, one of the options you purchased will gain profit faster than the other side loses.

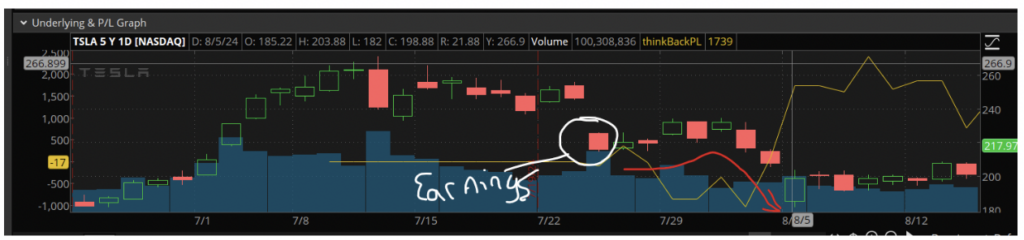

For example, Tesla (TSLA) reported earnings on July 23rd. At the time, buying a straddle that was roughly 25-30 days before expiration would have cost $3405 one day before the earnings announcement. The underlying was about $245 at the time.

What happened? The stock gapped down and over the next few days drifted lower, reaching a low of $182 on August 5th. The straddle netted an impressive $1739 profit on the initial $3405 investment, making a profit of 51% in a few days.

Why Use a Long Straddle?

Earnings reports can often lead to dramatic price swings, especially if the results or forward guidance surprise investors. If you anticipate a larger-than-expected price move but are unsure whether the stock will go up or down, a long straddle positions you to potentially profit regardless of the direction, as long as the move is large enough.

Risk and Volatility Considerations

The main risk with a long straddle is the volatility crush that typically follows earnings reports. Implied volatility (IV) tends to increase leading up to earnings, inflating option prices. Once the report is out, the IV collapses—regardless of the stock’s price movement—causing the value of both the call and put options to decrease, sometimes sharply. This means that even if the stock moves, it may not be enough to offset the loss from the IV drop.

Benefits of a Long Straddle:

- Profit potential from large stock movements in either direction.

- Limited risk, as the most you can lose is the premium paid for the options.

Risks:

- If the stock doesn’t move enough to compensate for the drop in implied volatility, the trade can lose value quickly.

- Expensive to initiate, particularly in high-IV environments before earnings.

The Bull Put Spread: A Directional Bet with Limited Risk

On the other hand, if you are more confident that the stock will move higher post-earnings, you might consider a bull put spread. This is a more directional trade, designed to profit from a stock that is expected to rise, albeit with limited upside potential. The trade involves selling a higher-strike put and buying a lower-strike put.

Why Use a Bull Put Spread?

A bull put spread is a conservative way to benefit from a stock moving higher. The trade generates income through the credit received when initiating the spread, and it profits as long as the stock stays above the strike price of the short put by expiration.

The key to this strategy during earnings is to set the spread lower than the market’s expected move. By doing so, the trade can still be profitable even if the stock doesn’t jump significantly after the earnings release.

Risk and Volatility Considerations

Volatility also plays a role here but in a different way. Since you’re selling options, you benefit from the post-earnings volatility crush, which can make it easier to close the trade profitably, even if the stock doesn’t move much. However, if the stock drops significantly below your short strike price, the loss potential is limited but real.

Benefits of a Bull Put Spread:

- Lower risk than a long stock or a naked put position.

- You benefit from the volatility crush, making it easier to take profits early if the stock moves higher or remains stable.

- Defined risk and reward, which can help manage position sizing.

Risks:

- Limited profit potential, as the spread caps your gains.

- If the stock moves significantly lower, you could still lose the maximum amount on the spread.

Comparing the Two Strategies

Both strategies have their place during earnings season, but they cater to different outlooks and risk tolerances:

- Long Straddle: Best for traders expecting a large move but unsure of the direction. However, it requires a significant move to overcome the effects of volatility crush.

- Bull Put Spread: Ideal for traders with a bullish bias who want to take advantage of the volatility crush and limited risk, but the upside is capped.

Finding The Expected Move

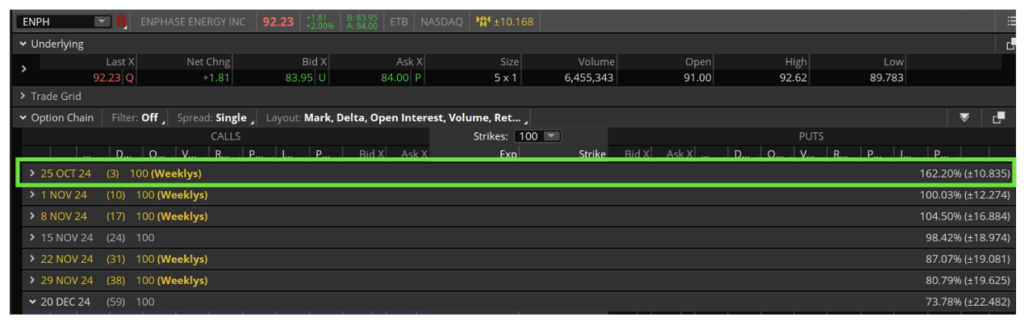

There are a variety of websites that will post the average one-day move after earnings. Some broker platforms have it as well. You can also look at the options chain for clues.

For example, in the Think-or-Swim platform, you can look at the implied volatility numbers for the expiration cycle after earnings.

Enphase (ENPH) released earnings after the bell on October 22nd and you can see from the options chain that the market was estimating a +/- $10.84 move before the expiration date on October 25th, three days after the announcement.

If you have a reason to believe that ENPH may have a greater than $10.84 move in either direction, you may wish to use the straddle strategy.

If you are unsure how much ENPH will move, but you think the market will be neutral to positive about the report, you can use a bull put spread and sell your put under the roughly $11 move to give yourself protection against a slight downward move.

What if you think the stock won’t move at all? That’s a different strategy for another article later this week.