Let’s start with the S&P 500, ticker: SPY. We’re near all-time highs, but the last couple of weeks have been a chop fest, with the market consolidating around the $570 level. But as a general rule, consolidation at the highs tends to lead to bullish continuations. Meaning, a breakout higher could be near.

What the chart above also shows is that the market has corrected through time rather than price. You can see that the symbol made a series of higher highs and higher lows, but then in the middle of September, the market went flat. Investors are comfortable with current levels, but the market is taking a breather.

What will help break the S&P 500 out from its consolidation pattern? The index is largely weighted with tech stocks, so let’s look at the Nasdaq-100 (QQQ). We’ve gone roughly 3 months without a new high, so that is troubling, but the QQQs have been on a run since the start of August and have been performing well.

Within the technology sector, what’s arguably the most important group? Chip stocks, aka the Semiconductors. Let’s look at how they are doing by using the ETF with a ticker of SMH.

The SMH is trading at an important level – one that it hasn’t been able to break above since mid-August, but there’s certainly room to grow if it can break free. It could easily go from the $255 level to over $280 before seeing real resistance levels.

Why do I think the semiconductors have a chance at breaking out from previous levels? What’s different this time around? Let’s look at what history tells us.

Start with NVIDIA (NVDA)’s historical chart and look at what happens from the end of September through the middle of November.

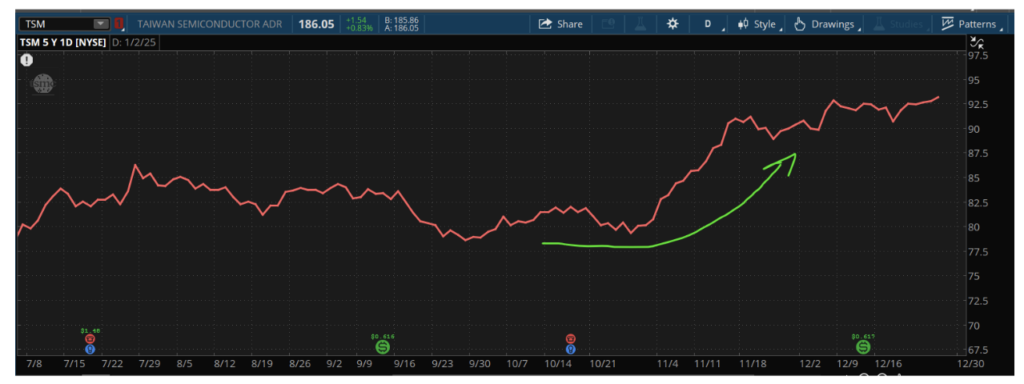

Or we can look at Taiwan Semiconductor (TSM):

Finally, here’s a historical performance chart of Advanced Micro Devices (AMD):

You may have noticed from the small icons at the bottom that these stocks perform well post-earnings, and so far the predictions for this upcoming earning season are bullish.

Consumers are still spending money. Artificial Intelligence is still a thing, and jobs haven’t completely disappeared as many feared they would.

What can spoil the bullish parade and sink the markets?

Well, the downside of stocks being at all-time highs is that wealthy people make money when the market rises. When wealthy people (fine, not-so-wealthy people too) see their accounts going up, they feel more wealthy and that means they spend more money! That’s not so good for inflation.

So while the Fed talks about focusing on the job market, we could see a resurgence in the discussion around Consumer Price Index (CPI) numbers.

For now, a 25 basis point cut seems safe and with that priced in already, we could see the market finally break out from here!