When looking for options to trade for income, one of our typical criteria is that a stock offers weekly options. The additional expiration dates give us more opportunities to generate income, as well as increased flexibility in managing positions.

However, there are occasions when we trade stocks that only have monthly options. For instance, perhaps you remember what we call a “monthly cash raid.” This strategy originated in the Perpetual Income program prior to that service being rolled into Income Masters.

It involves trading dividend stocks that only have monthly options. The trades are designed as one-offs where we buy a stock to earn the dividend and sell a covered call with the intent of being called out of shares at a profit.

One stock that we keep going back to for monthly cash raids is Iron Mountain (IRM).

Founded in 1951, Iron Mountain’s original business was the storage of documents and papers in enormous warehouses for commercial companies and government agencies. The business evolved in the 1990s and 2000s to include the scanning of documents as part of the storage process. By 2010, the company began moving into the electronic data storage business to compete with much larger companies.

IRM has significantly outperformed the broader market this year, rising 73%.

As we mentioned above, we first traded IRM in the Perpetual Income program, purchasing shares in mid-March at $80.33 the day before the stock was set to go ex-dividend.

We also sold an in-the-money IRM 19 Apr 80 Call, collecting a rich premium of $2.38, or $238 per contract. This lowered our cost basis on shares to $77.95. So, even if we had been called out by someone looking to own IRM to collect the dividend, we would have made a quick $205 profit. Our shares did not get called away, though, and we secured the $0.65 per-share quarterly dividend.

As you can see in the chart above, as the April monthly expiration approached, IRM dipped down to the mid-$70s. This was due mostly to the broader market sell-off that month. With our call out of the money, we decided to roll out a month to generate more income, picking up an additional $77 in premium and bringing our cost basis down to $77.18.

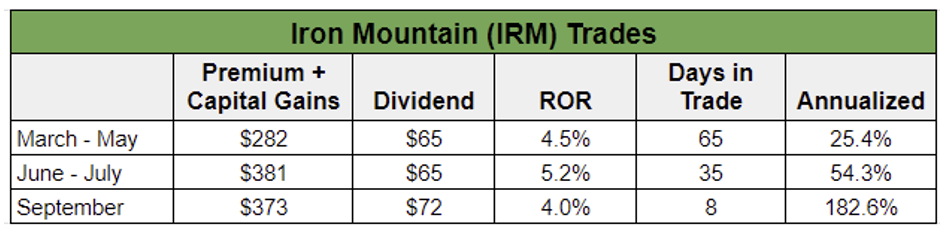

As the market recovered, IRM ran past our $80 call strike and our shares were called away on May 17. This left us with a profit of $282, plus the $65 in dividends, for a total profit of $347, or a 4.5% rate of return in 65 days. On an annualized basis, this works out to more than 25% a year, or roughly 10 times the stock’s forward annual dividend yield.

We went back to IRM just before the next quarterly dividend, purchasing shares in mid-June to secure the payout and selling a July call to generate additional premium. When we were called out the next month, we booked a profit of $446, including the dividend, for a 5.2% return in just over a month.

Given the success we’ve had trading IRM this way, we went back to the stock in September in the Income Masters program.

During the Sept. 10 live trading session, we bought 100 shares at $111.67 apiece and sold the IRM 20 Sep 115 Call for $0.65, bringing our cost basis on shares down to $111.02.

The stock was set to go ex-dividend on Monday, Sept. 16, paying a $0.715 per-share dividend on Oct. 3.

We knew there was a chance our shares would be called away ahead of the ex-dividend date. Yet, if that happened, we still stood to make a profit of $398 per 100 shares, for a 3.6% return in a matter of days.

Interestingly, although our call was in the money on Friday, Sept. 13, the last day for investors to own shares to collect the dividend, our shares were not called away in the live account. So, we ended up earning the dividend.

IRM continued to advance after going ex-dividend. And while we had held our past trades to expiration, we decided to close this latest trade early, as our buy-write position was sitting at a nice profit.

We sold our shares for $111.02, and while we had to pay $2.25 to buy back the call option, we booked a profit of $373 plus the dividend payout for a 4% return on our capital in just eight days.

Below you can see a breakdown of our three IRM trades and how we’ve been able to turn a dividend stock with a 2.4% annual yield into an income play throwing off a much higher cash rate of return.

IRM’s next dividend is likely to be announced in early November when the company reports quarterly earnings, with an ex-dividend date in mid-December. Provided nothing changes with the stock fundamentally or technically between now and then, we could go back for another monthly cash raid before the year is out.

While there are only a handful of stocks with monthlies only that we would consider trading this way, you can see how this strategy offers a nice boost to traditional dividend stocks.